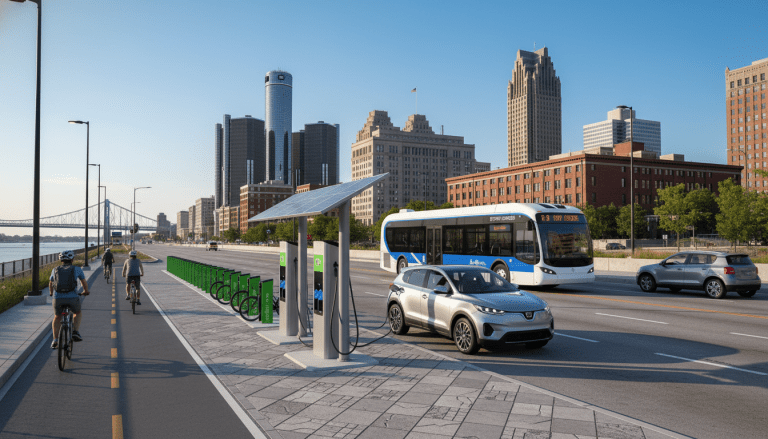

The long-debated Detroit Land Value Tax proposal is entering a crucial phase as city officials renew their push to restructure how property taxes are calculated across the city. Championed by Mayor Mike Duggan, the plan seeks to shift the tax burden away from homeowners and onto owners of vacant land and scrapyards, a move touted as a potential catalyst for neighborhood revitalization.

Under the current system, Detroit residents pay some of the highest property tax rates in the nation, while vacant land is taxed at a comparatively low rate. This structure has historically encouraged speculators to hold onto undeveloped properties without investing in them, stalling progress in the Detroit housing market. The proposed legislation aims to reverse this dynamic by implementing a split-rate tax system.

Impact on Detroit Homeowners

According to data released by the City of Detroit, the new tax structure would result in an average tax cut of 17% for 97% of Detroit homeowners. By lowering the millage rate on structures and increasing it on land, the administration hopes to make homeownership more affordable while discouraging blight.

“This is about fairness for the residents who have stayed and maintained their homes,” Mayor Duggan stated in a recent press briefing. “We are effectively punishing improvements and rewarding speculation. The Detroit Land Value Tax changes that equation.”

For residents living in neighborhoods heavily dotted with empty lots, the change could signal a shift in property values. Local economists suggest that reducing taxes on improvements encourages renovation, which aligns with recent neighborhood revitalization projects gaining traction throughout the city.

Addressing the Vacant Land Crisis

A primary driver behind the proposal is the abundance of vacant parcels that generate minimal revenue for the city. Speculators often purchase these lots cheaply and wait for values to rise due to nearby developments, contributing nothing to the local economy in the interim.

The Detroit Land Value Tax would more than double the tax rate on land, making it costly to sit on undeveloped property. The City of Detroit’s official proposal outlines that this revenue neutrality ensures the city budget remains stable while redistributing who pays the bill. Scrapyards and parking lots, which occupy prime real estate, would see significant tax increases, incentivizing owners to either develop the land or sell it to those who will.

Legislative Hurdles and Next Steps

Despite the support from city leadership and a coalition of community groups, the plan requires approval from the Michigan Legislature to authorize the local ballot measure. While the bill has navigated through various committees in Lansing, it faces opposition from interest groups concerned about the impact on commercial land holdings.

If the legislation passes in Lansing, the final decision will rest with Detroit voters. City officials are currently conducting town halls to explain the nuances of the tax shift. With the legislative session progressing, the coming months will be decisive in determining whether this structural overhaul becomes reality or remains a policy ambition.