The identity of Detroit has been inextricably linked to the internal combustion engine for over a century. However, as 2025 unfolds, the Detroit EV transition has moved from ambitious corporate PowerPoint presentations to the concrete realities of factory floors and city streets. Major automakers, including General Motors and Ford, are recalibrating their strategies, balancing the urgent push for electrification with market demands for hybrid alternatives, a shift that is fundamentally reshaping the region’s economic and technological landscape.

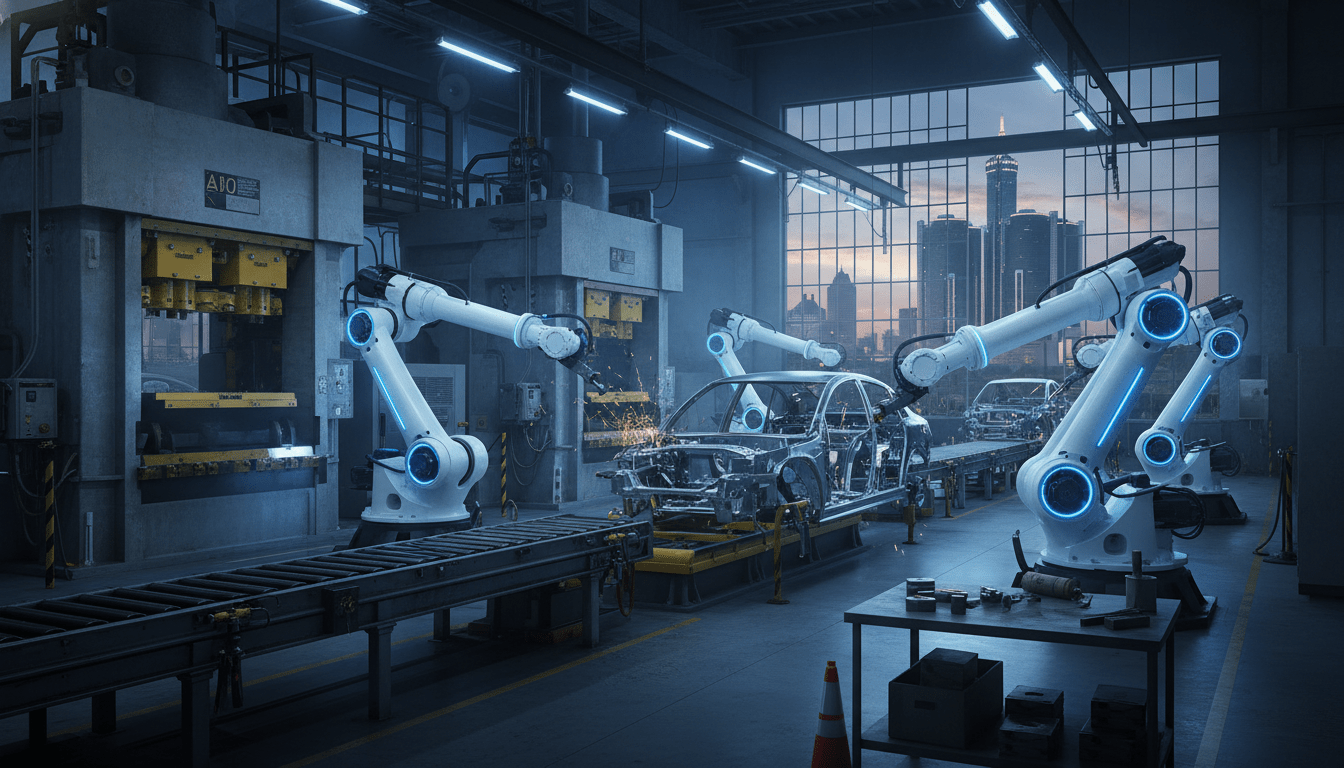

While the road to a fully electric future has proven bumpier than initially forecasted by industry analysts, the commitment to transforming Detroit into a global hub for mobility innovation remains steadfast. From the retooling of historic assembly plants to the development of new battery technology centers, the ripple effects of this industrial pivot are being felt across the metropolitan area.

The State of Detroit EV Manufacturing

According to recent data from the Michigan Economic Development Corporation (MEDC), the state has secured significant investments in the electric vehicle supply chain over the last three years. However, the operational reality is one of adjustment. General Motors, having transformed its Detroit-Hamtramck Assembly Center into "Factory ZERO," serves as the launchpad for the company’s all-electric future. Yet, the industry is witnessing a pragmatic pivot.

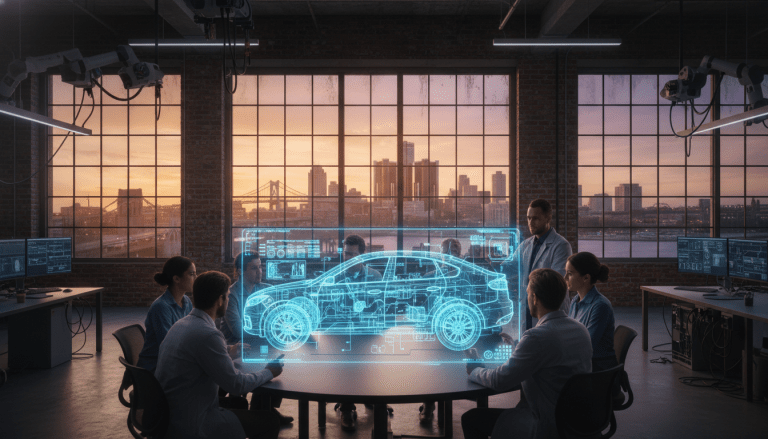

Industry reports indicate that while EV sales continue to grow, the rate of adoption has moderated, prompting Detroit’s "Big Three" to lean heavily into hybrid technologies as a bridge. "The transition isn’t a light switch; it’s a dial," noted a local automotive supply chain analyst during a recent industry roundtable. "Detroit is uniquely positioned because it has the engineering talent to handle both the legacy combustion platforms and the emerging high-voltage architectures required for the next decade."

Ford Motor Company’s revitalization of the Michigan Central Station in Corktown further underscores this tech-centric evolution. No longer just about assembly lines, the focus has broadened to include mobility software and autonomous driving technologies, aiming to attract a new demographic of tech workers to the city.

Impact on Detroit Residents and Workforce

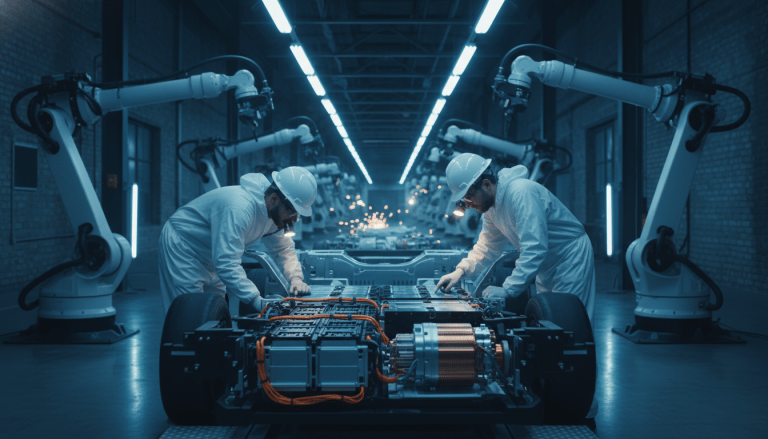

For the average Detroiter, the Detroit EV transition is not just a corporate headline; it is a matter of jobs and neighborhood infrastructure. The shift requires a workforce skilled in electronics, software management, and high-voltage safety, diverging significantly from traditional mechanical assembly roles.

Local educational institutions and workforce development programs are racing to close the skills gap. "We are seeing a surge in demand for electrical engineering technicians," said a representative from a Detroit-based workforce training partnership. "The goal is to ensure that Detroit residents are the first in line for these new roles, rather than importing talent from the coasts."

Beyond employment, the physical landscape of the city is changing. The deployment of public charging infrastructure remains a critical hurdle. While downtown and midtown areas have seen an increase in charging stations, residents in outer neighborhoods often face "charging deserts." The City of Detroit, in collaboration with DTE Energy, has outlined plans to expand equitable access to charging ports, acknowledging that widespread EV adoption is impossible if residents cannot charge their vehicles at or near their homes.

Background & Economic Data

The economic stakes of the Detroit EV transition are massive. According to the Michigan Economic Development Corporation, the automotive industry contributes over $300 billion to the state’s economy annually. Retaining this manufacturing base as the technology shifts is crucial for the region’s GDP.

However, challenges persist. Recent production pauses on specific electric models have caused uncertainty among supplier networks that rely on steady volume. Small to mid-sized manufacturers in the metro area are facing the "dual-tooling" dilemma—investing in equipment for EV parts while maintaining production for gas-powered vehicles, straining capital resources.

For more on how local businesses are adapting to these economic shifts, read our coverage on Detroit Business & Startups navigating the changing market.

The Role of Government Policy

Federal incentives from the Inflation Reduction Act continue to play a pivotal role in driving the Detroit EV transition. Tax credits for North American battery production have encouraged automakers to localize their supply chains within Michigan and the Midwest, rather than relying on overseas imports. This policy environment provides a safety net for manufacturers as they invest billions in capital improvements before seeing a full return on investment from EV sales.

What Happens Next?

Looking ahead to the remainder of the decade, Detroit’s automotive sector is expected to operate in a "mixed-mode" reality. The vision of an all-electric lineup remains the North Star, but the path there will involve a prolonged co-existence with hybrid powertrains.

The success of this transition will likely depend on three factors: the speed of infrastructure rollout, the affordability of EV models produced in Michigan, and the continued upskilling of the local labor force. As the industry evolves, Detroit remains the testing ground for whether a legacy industrial city can successfully lead a high-tech revolution.

For further reading on how technology is shaping our city’s landscape, explore our section on Detroit Tech and Innovation.