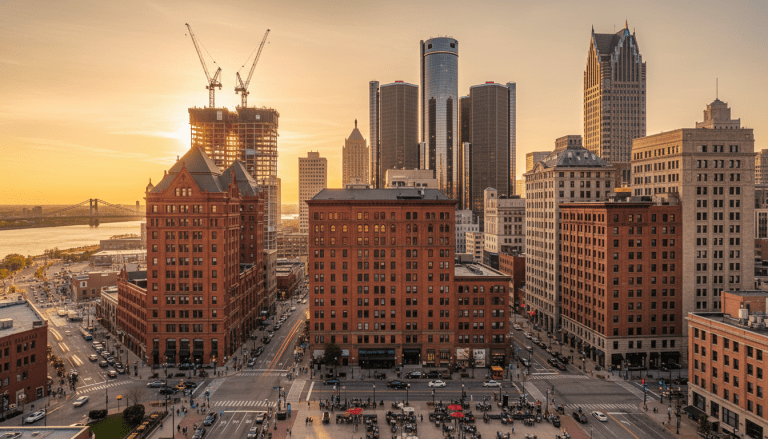

The skyline of Detroit is no longer just a symbol of past industrial might; it has become a tangible metric of the billions of dollars in capital flowing into the city’s central business district. As 2025 progresses, Downtown Detroit investment has shifted from speculative revitalization to a sustained era of vertical construction and infrastructure overhaul, driven by major stakeholders like Bedrock, the Ilitch organization, and public-private partnerships.

From the towering height of the new development at the historic Hudson’s site to the ground-level transformation of the University of Michigan Center for Innovation, the financial commitment to the city’s core is reshaping not just the geography, but the economic future of Southeast Michigan. According to data from the Downtown Detroit Partnership (DDP) and city reports, the volume of active construction and planned developments suggests that despite national economic headwinds, Detroit’s momentum remains resilient.

The Anchors of Development: Hudson’s and Beyond

At the center of the current investment surge is the mixed-use development at the former J.L. Hudson’s department store site. Managed by Bedrock, the project has been described as a defining architectural addition to the city. Now officially impacting the skyline, the development represents a commitment of over $1.4 billion. It serves as a barometer for high-end office and residential demand in the post-pandemic era.

“The completion of the structural phase of the Hudson’s development marks a pivotal moment for Detroit real estate,” noted a spokesperson for Bedrock in a recent press statement. “This is not just about adding square footage; it is about creating a destination that attracts global talent and retains local residents.”

However, the Hudson’s site is not operating in a vacuum. Just blocks away, the University of Michigan Center for Innovation (UMCI) is rapidly moving forward. This $250 million world-class research and education center, funded significantly by a donation from Stephen M. Ross and backed by the State of Michigan, is expected to catalyze a new tech corridor within the District Detroit area. Analysts predict this specific injection of Downtown Detroit investment will bridge the gap between academic research and commercial enterprise, potentially mirroring the tech hubs seen in other major metropolitan areas.

Impact on Detroit Residents and Local Economy

While cranes and glass facades dominate the visual narrative, the impact of this investment on long-term Detroit residents remains a critical focal point of discussion. The City of Detroit has enforced strict Community Benefits Ordinances (CBO) to ensure that mega-developments provide tangible value to neighborhoods outside the immediate downtown core.

According to the City of Detroit’s Housing and Revitalization Department, developers seeking tax incentives are generally required to set aside 20% of new residential units for affordable housing at 80% of the Area Median Income (AMI). For locals, this policy is the firewall against total displacement, though advocates often argue that deeper affordability is needed.

Local business owners are also feeling the ripple effects. “The foot traffic has changed,” said Marcus Turner, a manager at a retail outlet near Woodward Avenue. “We are seeing more consistent activity during the week, not just on game days. The new corporate tenants and the residents moving into these converted buildings are creating a steady baseline of customers that we didn’t have five years ago.”

Furthermore, the job market associated with these investments extends beyond construction. The operational phase of the UMCI and the Hudson’s site is projected to support thousands of permanent jobs, ranging from facility management to high-tech research roles.

Commercial vs. Residential Shifts

A notable trend in recent Downtown Detroit investment strategy is the pivot from pure office space to residential and hospitality. With the national commercial office market facing uncertainty due to remote work trends, Detroit developers have adapted. Historic buildings that once housed banks and law firms are increasingly being eyed for residential conversion.

Reports from the Detroit Economic Growth Corporation (DEGC) indicate that residential occupancy rates in the Central Business District remain high, hovering above 90%. This demand is driving investors to prioritize “lifestyle” developments—projects that include amenities like grocery stores, gyms, and green spaces within the building footprint.

This shift is vital for creating a “15-minute city” environment where residents can live, work, and play without relying heavily on automotive transport, a somewhat ironic but necessary evolution for the Motor City.

The District Detroit and Future Outlook

Looking ahead, the spotlight remains on the “District Detroit,” a massive proposal led by Olympia Development of Michigan and Related Companies. Valued at approximately $1.5 billion, this proposal aims to fill the “missing teeth”—the surface parking lots—between downtown and Midtown with dense, mixed-use structures.

While progress has been slower than some residents hoped, recent filings suggest renewed activity. The successful hosting of the NFL Draft in 2024 proved Detroit’s capacity to handle large-scale attention, arguably boosting investor confidence for these long-term projects.

“The infrastructure is in place, and the global perception of Detroit has shifted from a distress story to a growth story,” said an urban planning analyst from Wayne State University. “The challenge for the next five years of Downtown Detroit investment will be connecting these isolated islands of development into a cohesive, walkable urban fabric.”

What to Watch in Late 2025

As the year progresses, industry experts recommend keeping an eye on three key indicators:

- Interest Rates: High rates have stalled some projects; any federal relief could accelerate grounded proposals.

- Suburban Migration: The rate at which suburban companies continue to move HQs downtown (like the recent moves by major automotive suppliers).

- Transit Connectivity: Any new announcements regarding the QLINE or regional transit integration to support the growing downtown workforce.

For more coverage on how development is changing the region, read our analysis on Detroit’s neighborhood housing markets.

Ultimately, the trajectory of Downtown Detroit investment appears upward, anchored by institutional heavyweights and supported by a local government focused on leveraging private dollars for public benefit.