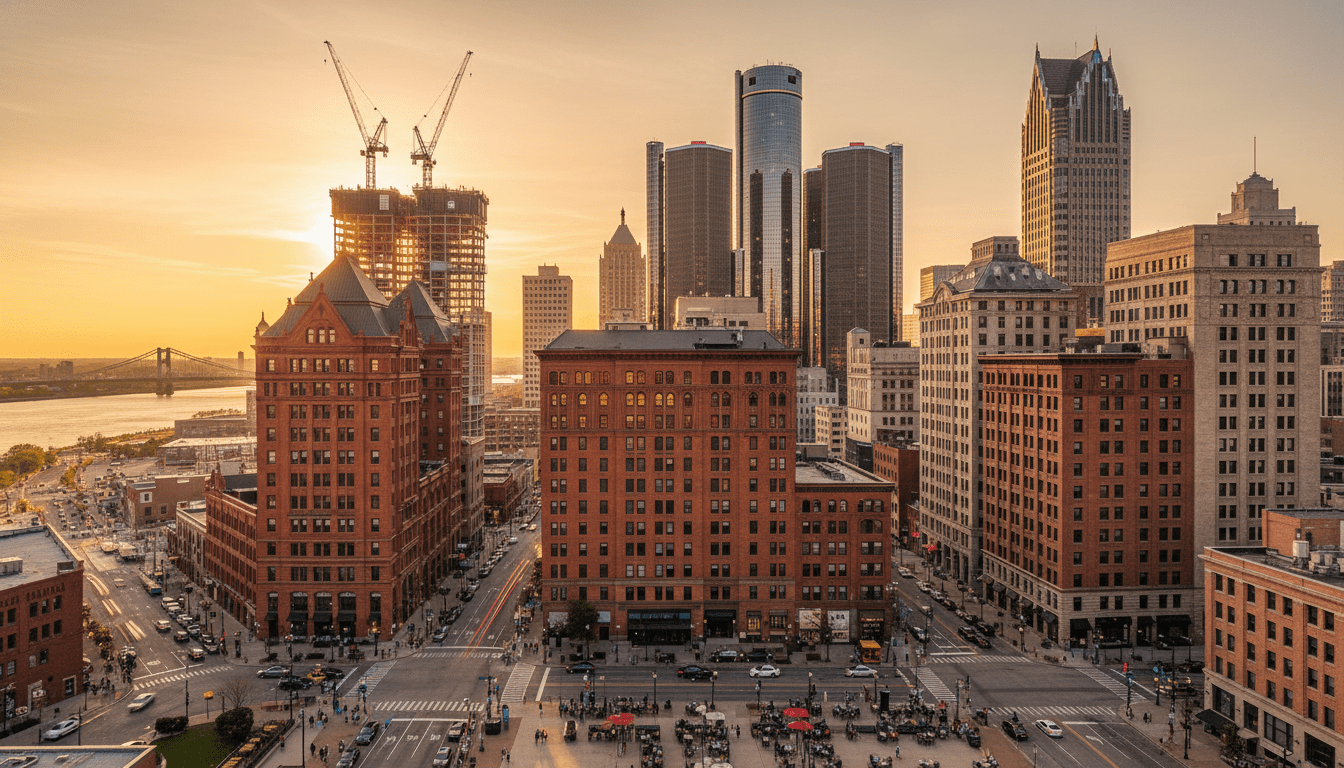

The landscape of Detroit commercial real estate is undergoing a significant transformation as the city moves further into the post-pandemic economic cycle. While the iconic skyline changes with the addition of new towers, the underlying dynamics of office space, retail density, and industrial demand are shifting beneath the surface. For developers, investors, and local business owners, the current market presents a complex mix of challenges regarding vacancy rates and opportunities found in adaptive reuse.

As major developments like the Hudson’s site near completion and Michigan Central begins to activate Corktown, the narrative of downtown development is evolving from simple occupancy to strategic placemaking. Data from industry analysts suggests a clear bifurcation in the market: a “flight to quality” for premium office spaces, contrasted with a growing need to repurpose older Class B and C buildings.

The Shift in Detroit’s Office Market

The traditional office sector within the Central Business District (CBD) faces headwinds similar to other major metropolitan areas in the United States. Hybrid work models have permanently altered how companies utilize square footage. However, Detroit has shown unique resilience due to the heavy concentration of automotive and tech-adjacent industries that often require physical collaboration.

According to recent reports on the Detroit commercial real estate sector, vacancy rates in older office buildings remain elevated. Conversely, Class A properties—buildings featuring modern amenities, green spaces, and high-tech infrastructure—are seeing steady leasing activity. This trend indicates that businesses are not abandoning the city, but rather upgrading their footprints to entice workers back to the office.

The Downtown Detroit Partnership and other local stakeholders have noted that foot traffic is recovering, driven largely by event activations and the return of major conventions. However, the days of filling massive skyscrapers solely with cubicles may be ending, paving the way for mixed-use developments that blend workspace with hospitality and residential units.

Adaptive Reuse: Transforming Vacancy into Housing

One of the most significant trends impacting the Detroit commercial real estate market is adaptive reuse. As demand for traditional office space softens, developers are increasingly looking at converting historic high-rises into residential apartments and condos. This strategy addresses two problems simultaneously: reducing office vacancy and alleviating the city’s housing shortage.

City officials have voiced support for these conversions, recognizing that a vibrant downtown requires a 24-hour population, not just a 9-to-5 workforce. Several high-profile buildings in the financial district are currently under study or in the early stages of conversion. This shift is crucial for the local business climate, as an increase in permanent residents drives demand for grocery stores, service providers, and evening entertainment, creating a more sustainable local economy.

Impact on Detroit Residents

For the average Detroiter, the shifts in commercial real estate have tangible effects on daily life and neighborhood stability. The boom in industrial and logistics real estate—often located just outside the downtown core—has generated a steady stream of construction and warehousing jobs. The repurposing of commercial land for industrial use remains a strong sector, driven by the supply chain needs of the automotive industry.

Furthermore, the focus on mixed-use developments means that neighborhoods are becoming more walkable. New commercial projects are increasingly required to include ground-floor retail, which provides opportunities for small business entrepreneurs. Local business owners have said that being integrated into these larger commercial developments offers them visibility and stability that standalone storefronts sometimes lack.

However, residents also express concerns regarding affordability. As commercial investment increases property values, ensuring that the new housing stock created through adaptive reuse remains accessible to long-term residents is a policy priority for city planners.

Industrial and Retail Resilience

While the office market recalibrates, other sectors of Detroit commercial real estate are performing robustly. The industrial market continues to see low vacancy rates. The demand for modern manufacturing facilities and distribution centers is high, fueled by the electric vehicle (EV) transition led by General Motors and Ford.

In terms of retail, the strategy has shifted from large chain dominance to experiential retail and boutique storefronts. The resurgence of neighborhood commercial corridors, such as the Avenue of Fashion on Livernois or the developments in Southwest Detroit, highlights a decentralization of commercial wealth. Money is flowing not just into the CBD, but into the commercial arteries that serve Detroit’s neighborhoods.

Major Development Updates

- Hudson’s Site: Nearing final completion stages, this mixed-use tower is set to redefine the skyline and offer premier office, hotel, and residential space.

- Michigan Central: Ford’s innovation district in Corktown is attracting mobility startups, creating a new commercial hub west of downtown.

- The District Detroit: Ongoing discussions and groundbreaking regarding the area connecting Midtown and Downtown continue to promise mixed-use expansion.

Background & Data

Historical data from the U.S. Census Bureau and local economic development agencies highlight the trajectory of Detroit’s recovery. Since the bankruptcy exit, billions have been invested in commercial projects. However, the current high-interest-rate environment has slowed the pace of new ground-up construction, making renovations and adaptive reuse more financially viable than new builds in the short term.

Market analysis indicates that rental rates for Class A office space have held steady, while Class B and C spaces are seeing downward pressure on pricing. This price gap offers opportunities for non-profits and smaller startups to enter the downtown market at more affordable rates than seen in previous years.

What Happens Next

Looking ahead to late 2025 and beyond, the Detroit commercial real estate market is expected to stabilize around a new normal. The focus will likely remain on “placemaking”—creating environments where people want to be, rather than just where they have to work.

Experts predict continued strength in the industrial sector and a slow, steady absorption of office space as the Detroit city infrastructure continues to improve. For investors, the long-term play remains bullish on Detroit, provided they are willing to adapt to the changing needs of a hybrid workforce and a residential-focused downtown.