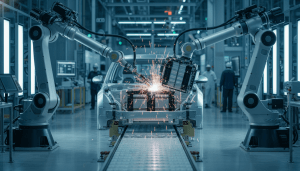

The heartbeat of the Motor City is changing rhythm. For over a century, the pulse of Detroit was measured in the combustion of gasoline and the stroke of pistons. Today, however, the industry’s focus has shifted entirely to the chemistry of energy storage. As General Motors, Ford, and Stellantis navigate the most significant transformation in automotive history, the race to master EV battery technology has become the new battleground for dominance in the global market.

While the transition to electric vehicles (EVs) has been volatile, marked by fluctuating demand and supply chain hurdles, Detroit’s automakers are not pulling back on research and development. Instead, they are deepening their investments in battery chemistry, aiming to solve the three critical hurdles to mass adoption: range, charging speed, and cost.

The Shift to Solid-State and LFP Chemistries

For the past decade, lithium-ion batteries using liquid electrolytes have been the standard. However, the industry is aggressively pursuing alternatives that offer better performance and safety. According to recent reports from the U.S. Department of Energy, the push for solid-state batteries is intensifying. These batteries, which replace the liquid electrolyte with a solid material, promise higher energy density and reduced fire risk—a potential game-changer for the industry.

“The holy grail of EV battery technology is the solid-state cell,” said Dr. Marcus Thorne, an automotive analyst specializing in propulsion systems. “Whoever can mass-produce solid-state batteries at a competitive price point will likely control the market for the next two decades. Detroit knows this, which is why we are seeing such aggressive partnerships with chemical firms and startups.”

Simultaneously, there is a pragmatic pivot toward Lithium Iron Phosphate (LFP) batteries. While LFP batteries typically have a lower energy density than their nickel-cobalt-manganese counterparts, they are cheaper to produce and more durable. Ford, for instance, has signaled a strong interest in integrating LFP chemistry into its lineup to lower the entry price for consumers, a move crucial for mainstream adoption.

Detroit Innovation Centers Leading the Charge

The innovation isn’t just happening in Silicon Valley or overseas; it is centered right here in Southeast Michigan. General Motors has staked its future on the Ultium platform, a modular battery architecture designed to power everything from compact commuters to the massive Hummer EV. The Wallace Battery Cell Innovation Center in Warren is GM’s proving ground, where engineers work to accelerate the development of new chemistries.

Similarly, Ford is investing heavily in its Ion Park in Romulus. This center of excellence is dedicated to scaling battery technology and manufacturing processes. By verticalizing the supply chain—bringing battery development in-house—Detroit automakers are attempting to insulate themselves from the geopolitical volatilities that have plagued the semiconductor and raw material markets in recent years.

Impact on Detroit Residents and the Local Economy

For the workforce in Metro Detroit, the shift in EV battery technology represents both a challenge and an opportunity. The skills required to build an internal combustion engine differ vastly from those needed to manufacture battery cells and electric drive units. This transition is reshaping the local labor market.

“We are seeing a fundamental change in the types of jobs being posted in the region,” noted Sarah Jenkins, a workforce development coordinator in Wayne County. “There is a massive demand for chemical engineers, electrical technicians, and software developers. For the assembly line worker, it means retraining. The plants are cleaner and quieter, but the technical requirements are higher.”

This evolution is also impacting real estate and infrastructure. New development projects in Detroit are increasingly centered around tech corridors and logistics hubs designed to support the EV supply chain. Furthermore, the state of Michigan has been aggressive in securing battery plant investments to ensure that the “Battery Belt” runs through the Midwest rather than shifting entirely to the South.

University Research and Public-Private Partnerships

The ecosystem supporting these advancements extends beyond the corporate headquarters of the Big Three. The University of Michigan remains a critical hub for foundational research. The U-M Battery Lab allows academic researchers and industry partners to prototype and test new cell designs in a realistic manufacturing environment.

Recent federal initiatives have also injected capital into the region. Funding aimed at domestic manufacturing of battery components has bolstered local suppliers who are pivoting from traditional powertrain parts to battery casings, thermal management systems, and high-voltage wiring.

Addressing the Cold Weather Challenge

One specific area where Detroit engineering is being tested is performance in extreme climates. It is a well-known limitation that current EV battery technology suffers in freezing temperatures—a reality familiar to any Michigander in January. Range loss in cold weather remains a significant barrier for local buyers.

To combat this, local engineering teams are developing advanced thermal management systems. By utilizing heat pumps and waste heat recovery more efficiently, automakers hope to mitigate range loss. “The goal is to make the battery invisible to the user experience,” Thorne added. “Whether it’s 90 degrees or 10 below zero, the driver shouldn’t have to worry if they can make it home. That is the engineering standard Detroit is aiming for.”

What Happens Next?

As 2025 progresses, the industry expects to see the first pilot production runs of next-generation cells. While widespread commercial availability of solid-state batteries may still be a few years away, the incremental improvements in current lithium-ion tech are happening monthly. Energy densities are rising, and charging times are falling.

For Detroit, the stakes could not be higher. The city’s economic resurgence is tightly coupled with the success of its automakers in this new era. If Detroit can lead the world in innovative tech solutions for electrification, it will secure its title as the Motor City for the next century. If not, the center of gravity for the automotive world could shift permanently elsewhere.

The consensus among local leaders and industry heads is clear: the technology developed in laboratories in Warren, Dearborn, and Ann Arbor today will determine the global automotive landscape of tomorrow.