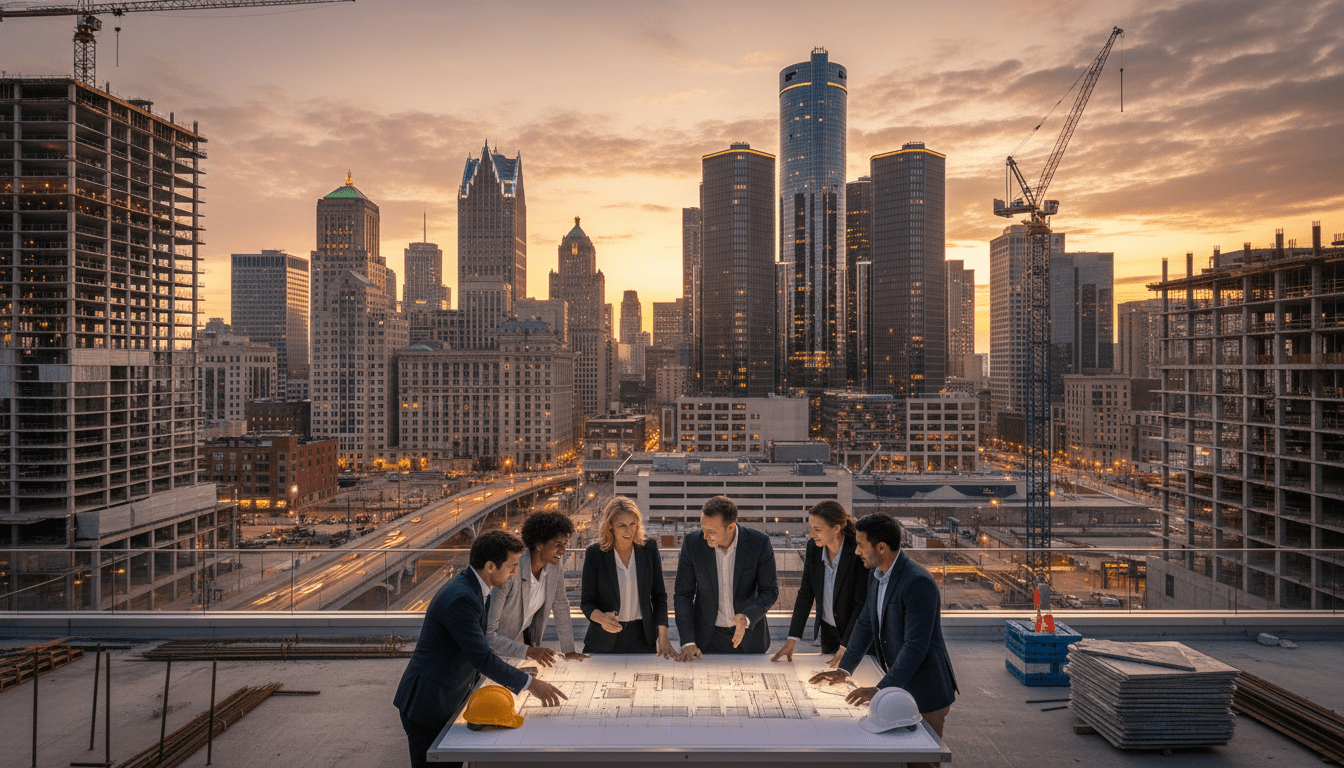

Detroit’s economic narrative is undergoing a significant transformation. Long viewed through the lens of distressed assets and recovery, the city is shifting toward a phase of sustained growth and diversification. For investors and business leaders, the landscape of Detroit investment opportunities is expanding beyond the traditional automotive manufacturing sector into technology, green energy, and neighborhood-focused real estate development.

According to recent reports from the Detroit Regional Chamber, the city is outpacing national averages in several key recovery metrics post-pandemic. This resurgence is driven by a coordinated effort between public policy and private capital, creating a fertile ground for venture capital and small business expansion. As 2025 approaches, the focus is increasingly on innovation districts and equitable development that benefits long-term residents.

The Rise of Innovation Districts

One of the most visible drivers of new capital is the development of innovation districts, most notably the Michigan Central district in Corktown. Ford Motor Company’s restoration of the historic train station is not merely a preservation project; it serves as an anchor for mobility-focused startups and tech firms. This concentration of talent and resources is creating a ripple effect, drawing venture capital attention to the region.

Data from the Michigan Economic Development Corporation (MEDC) suggests that the state’s “Make It in Michigan” strategy is successfully leveraging federal funding to attract high-tech manufacturing and R&D. For investors, this signals a maturing ecosystem where early-stage tech companies—particularly those in mobility, fintech, and clean energy—are becoming viable targets. The convergence of hardware manufacturing expertise with software development is creating a unique value proposition that Silicon Valley cannot easily replicate.

“We are seeing a shift where capital is looking for tangible assets and realistic growth,” said a representative from a local business incubator during a recent economic forum. “Detroit offers the infrastructure and the talent pool that makes it a prime location for scalable investments in the hard-tech space.”

Real Estate: Moving Beyond Downtown

While downtown Detroit remains a hub for commercial activity, smart money is increasingly moving into the neighborhoods. The City of Detroit’s Strategic Neighborhood Fund has highlighted the potential in areas like the Livernois-McNichols corridor, Southwest Detroit, and the Jefferson Chalmers area. These Detroit investment opportunities in real estate are characterized by mixed-use developments that combine affordable housing with retail space.

For residential investors, the market is stabilizing. The days of bulk buying distressed properties for pennies are largely over, replaced by a demand for quality rehabilitation and new construction. Recent real estate trends indicate that multi-family units in emerging neighborhoods are seeing steady appreciation. This shift is supported by city initiatives aimed at blight removal and land bank reforms, making it easier for developers to acquire and improve lots.

Impact on Detroit Residents

The influx of investment carries significant implications for local residents. A primary goal for city officials is ensuring that economic growth translates into wealth generation for Detroiters. Programs like Motor City Match have been instrumental in connecting entrepreneurs with the capital and physical space needed to open businesses. By prioritizing local ownership, the city aims to keep economic value circulating within the community.

However, the rapid pace of development also brings challenges regarding affordability and displacement. Local community groups emphasize the need for development agreements that include community benefits, such as guaranteed affordable housing units and hiring requirements for local workers. For ethical investors, the most sustainable Detroit investment opportunities are those that align with these community needs, fostering goodwill and long-term stability.

Residents are also benefiting from the job creation associated with these investments. As tech hubs and green energy plants come online, there is a growing demand for skilled labor. Workforce development programs are ramping up to ensure that Detroiters are the first in line for these new positions, bridging the gap between corporate investment and household income.

Background & Market Data

The investment climate is supported by robust data. According to the U.S. Bureau of Labor Statistics, the Detroit metropolitan area has seen consistent employment growth in the professional and business services sector. Furthermore, the cost of doing business in Detroit remains significantly lower than in coastal tech hubs. Commercial rents and cost of living metrics allow startups to extend their runway, making the city an attractive option for relocating businesses.

In the clean energy sector, federal incentives from the Inflation Reduction Act are catalyzing projects across Michigan. Detroit is positioned to be a beneficiary of this spending, particularly in electric vehicle (EV) charging infrastructure and battery assembly support. Investors looking at the macro trends will find that Michigan’s commitment to becoming a climate leader is creating subsidized pathways for entry into the green economy.

What Happens Next

Looking ahead, the trajectory for business and startups in Detroit appears resilient. The city is preparing for a future where it is defined not just by what it manufactures, but by what it innovates. The continued collaboration between the Detroit Economic Growth Corporation (DEGC), private philanthropy, and institutional investors will likely focus on scaling small businesses into mid-sized enterprises.

For potential investors, the window of opportunity is open, but the strategy requires local knowledge. Success in the Detroit market in 2025 and beyond will depend on understanding the nuances of neighborhood dynamics and aligning capital with the city’s broader strategic goals of inclusive growth.