For the first time in decades, a significant majority of Detroit neighborhoods are seeing a sustained rise in property values, marking a pivotal economic shift for the city. According to the latest assessment data released by the City of Detroit, residential property values increased by an average of 23% across the city in the last assessment cycle, a trend that is finally bridging the gap between the downtown core and the city’s outlying residential districts.

This surge represents more than just statistics on a ledger; for thousands of long-term residents, it means the accumulation of generational wealth after years of stagnation or decline. However, the rapid appreciation of Detroit property values also brings complex challenges regarding property taxes and housing affordability.

Analysis of the 2024-2025 Assessment Data

The City of Detroit’s Office of the Assessor reported that nearly every neighborhood in the city experienced an increase in value this year. This contrasts sharply with the era of the foreclosure crisis a decade ago, where values plummeted, and the tax foreclosure auction was the primary method of property transfer.

City officials have noted that the rise in values is driven by genuine market activity—meaning people are buying homes through traditional mortgages rather than just cash auctions. Mayor Mike Duggan has frequently cited this shift as evidence that the city’s strategy to remove blight and renovate salvageable homes is paying dividends for homeowners who stayed through the difficult years.

According to data from the City of Detroit, the aggregate value of Detroit’s residential property has grown by billions over the last five years. This growth is essential for the city’s fiscal health, as property taxes fund vital services including police, fire, and parks.

The Rise of ‘Middle Neighborhoods’

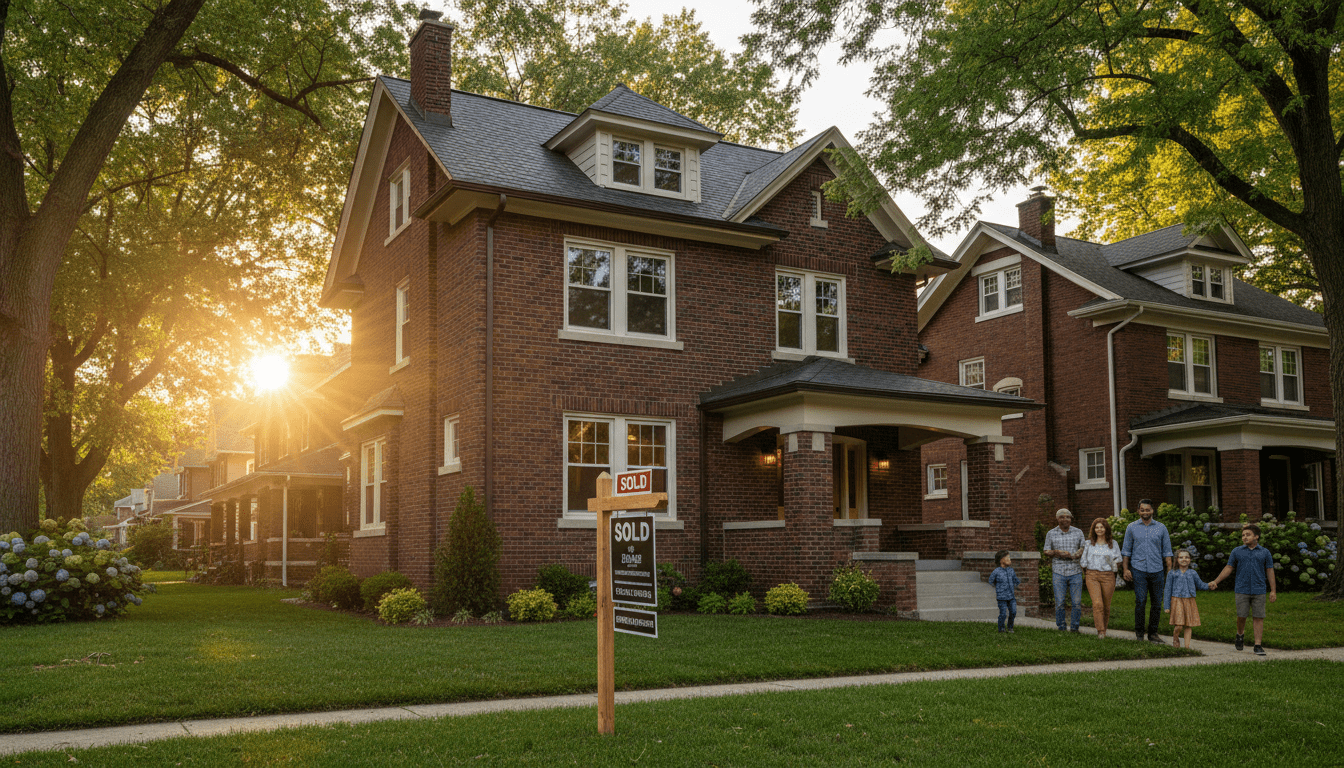

While the resurgence of Midtown, Downtown, and Corktown has been well-documented, the current story of Detroit property values is centered on the so-called “Middle Neighborhoods.” These are areas like Bagley, East English Village, Fitzgerald, and Grandmont Rosedale—communities that remained relatively stable but are now seeing double-digit growth in equity.

Real estate analysts point out that inventory in these neighborhoods is low, driving up competition. As prices in the suburbs remain historically high, buyers are increasingly looking within city limits for high-quality, historic brick housing stock. This demand is closing the “appraisal gap”—a phenomenon where the cost to renovate a home exceeded its post-renovation value. Closing this gap is critical because it allows banks to lend money for renovations, reducing the reliance on cash-only investors.

Local real estate agents have reported that homes in these zip codes, which might have sat on the market for months five years ago, are now seeing multiple offers within the first week of listing.

Impact on Detroit Residents and Homeowners

For existing homeowners, rising Detroit property values are a double-edged sword. On one hand, it increases borrowing power. Residents can now tap into home equity to fund repairs, start businesses, or pay for education—a financial lever that was largely inaccessible to Detroiters for nearly two decades.

“We are finally seeing the market reflect the true value of these homes,” said a representative from a local housing non-profit during a recent community meeting. “Families who held on now have an asset that is actually worth something significant.”

However, fears regarding property taxes loom large. Michigan law, specifically Proposal A, caps the increase in a homeowner’s taxable value at the rate of inflation (roughly 5% this year) or 5%, whichever is lower, as long as the property is not sold. This protects current residents from massive tax hikes despite the 23% jump in assessed value.

Despite these protections, residents must remain vigilant. The “uncapping” of taxes upon a sale remains a concern for new buyers, and the overall cost of living in the city is rising. To combat displacement, organizations are urging residents to utilize the HOPE property tax exemption program, which eliminates or reduces property taxes for low-income homeowners.

Closing the Appraisal Gap

One of the most significant indicators of the market’s health is the reduction of the appraisal gap. For years, Detroit suffered from a market failure where banks would not write mortgages because there were no comparable sales (“comps”) to justify the loan amount. This forced buyers to pay cash, limiting homeownership to investors or the wealthy.

With Detroit property values rising, comparables are now sufficient in many neighborhoods to support traditional lending. This shift is crucial for fostering a higher rate of owner-occupancy, which generally leads to more stable neighborhoods compared to areas dominated by absentee landlords.

The Context of the Land Value Tax Proposal

The conversation around rising assessments is occurring parallel to the debate over the proposed Land Value Tax (LVT). Mayor Duggan’s administration has pushed for this legislative change, which would lower taxes on structures (homes) while increasing taxes on land. The goal is to discourage land speculation—where investors sit on empty lots or blighted buildings waiting for values to rise—and encourage development.

If passed, the LVT could significantly alter the landscape of Detroit property values again, potentially lowering bills for homeowners who maintain their properties while penalizing blight holders. Read more about recent legislative updates on the Land Value Tax to understand how this could impact specific districts.

What Happens Next?

Looking ahead to the remainder of 2024 and into 2025, experts predict a stabilization of the market. While the explosive growth of the post-pandemic era may slow, a steady, sustainable increase is expected. The focus for the city remains on ensuring that this growth is inclusive.

The Detroit Land Bank Authority continues to auction properties, though the inventory of salvageable structures is shrinking. This scarcity is expected to further drive demand toward the private market, reinforcing the upward trend in valuations.

For Detroiters, the message is clear: the market has recovered, but navigating the complexities of assessments, exemptions, and taxes is more important than ever.