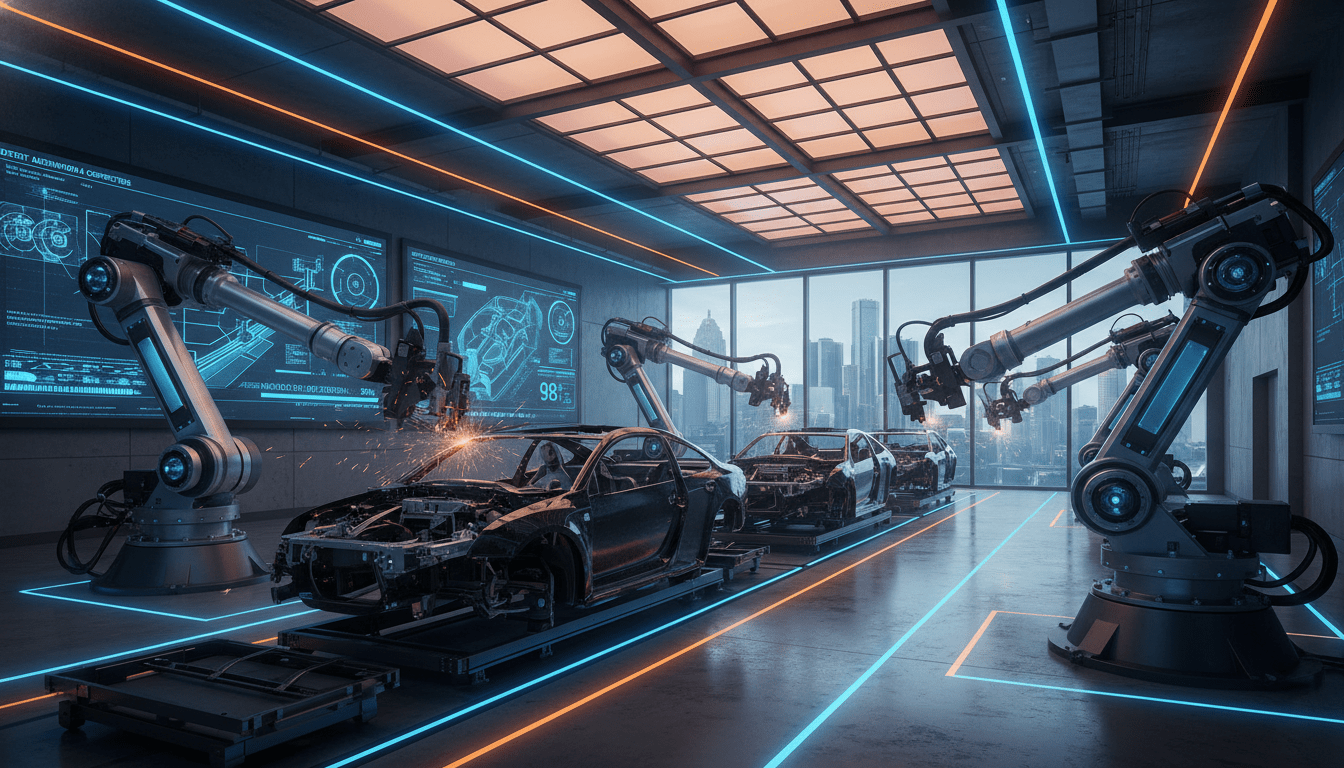

For decades, Detroit was synonymous with heavy steel and the rhythmic pounding of assembly lines. While the automotive spirit remains the city’s beating heart, the materials fueling its economic engine are undergoing a radical transformation. A quiet revolution in Detroit advanced manufacturing is shifting the focus from traditional heavy metals to aerospace-grade alloys, carbon fiber, and lightweight composites, positioning the city as a global hub for material science innovation.

As the automotive industry pivots toward electric vehicles (EVs), the demand for lighter, stronger materials has never been higher. To increase battery range, vehicles must shed weight without sacrificing safety. This engineering paradox is being solved right here in Detroit, where federally funded institutes, university research centers, and legacy automakers are collaborating to forge a new industrial identity for Southeast Michigan.

The New Hub of Material Innovation

Central to this shift is the presence of organizations like LIFT (Lightweight Innovations For Tomorrow). Located in the Corktown neighborhood, LIFT is a Department of Defense-supported national manufacturing innovation institute. Their facility acts as a sandbox for the future, where industry giants and startups alike test new methods to bond metals, print components via additive manufacturing, and develop lighter armor for military vehicles and lighter chassis for civilian cars.

According to recent reports from the Michigan Economic Development Corporation (MEDC), the state’s concentration of engineering talent is the highest in the nation. This density of expertise is attracting investment not just in final assembly, but in the upstream development of the materials themselves. “We are no longer just bending metal; we are engineering the molecular structure of the components that move the world,” said a representative from a local engineering firm partnering with Wayne State University.

This transition is vital for the local automotive sector. General Motors and Ford have both invested billions into retrofitting factories, but the supply chain supporting these factories is becoming increasingly high-tech. The shift toward Detroit advanced manufacturing means that the region is now competing with Silicon Valley and Boston for leadership in material tech.

Impact on Detroit Residents and the Workforce

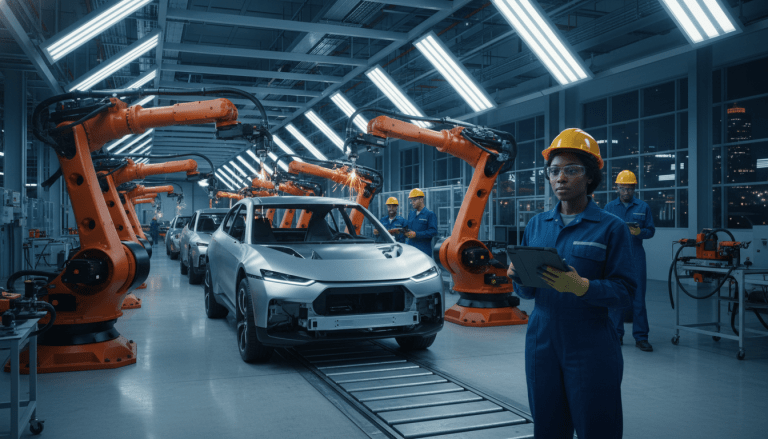

For the average Detroit resident, this industrial evolution presents both a challenge and a massive opportunity. The jobs of the past—often repetitive manual labor—are being replaced by roles that require a blend of mechanical skill and digital literacy. However, local leaders are adamant that this transition must not leave Detroiters behind.

Workforce development programs are springing up to bridge the gap. Partnerships between Focus: HOPE, local community colleges, and industry leaders are designing curriculums specifically for advanced manufacturing. These programs aim to train locals in operating CNC machines, managing 3D printers for industrial use, and conducting quality assurance on new composite materials.

“The narrative that manufacturing jobs are disappearing is false,” explained a workforce development coordinator in Midtown. “They are evolving. We need technicians who can manage robotics and understand material properties. These are high-paying careers, and they are available right here in the city for those who seek out the training.”

This directly impacts the local economy. As these high-value jobs are filled by residents, wages rise, fueling spending in Detroit’s local neighborhoods and small businesses. The ripple effect of a modernized manufacturing base is essential for the city’s long-term financial stability.

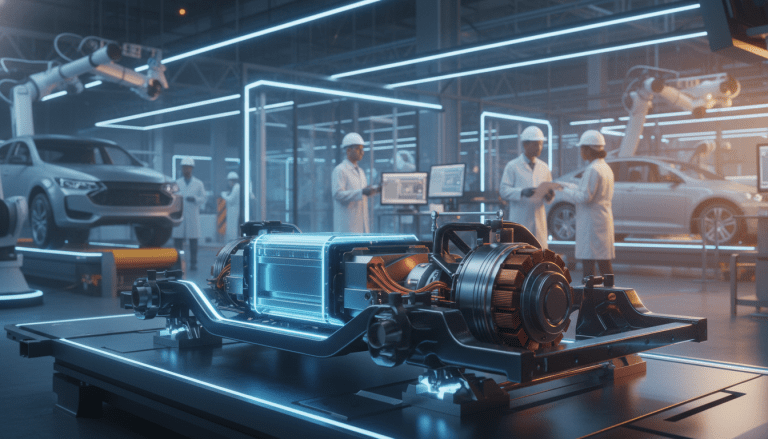

The EV Connection: Why Weight Matters

The urgency behind the push for advanced materials is largely dictated by the electric vehicle race. Batteries are heavy. To compensate for the weight of a battery pack, which can exceed 1,000 pounds, the rest of the vehicle must be as light as possible. This has sparked a “lightweighting” boom in Detroit advanced manufacturing.

Engineers are replacing steel suspension components with aluminum and swapping heavy dashboard supports for magnesium or carbon fiber composites. This isn’t just about making cars go faster; it’s about efficiency. A lighter car requires less energy to move, extending the range—a critical selling point for consumers with range anxiety.

Furthermore, sustainable manufacturing is becoming a priority. New processes being developed in Detroit aim to reduce the energy required to produce these materials. Recycling carbon fiber, for instance, is a notoriously difficult process that local startups are currently attempting to solve, aiming to create a circular economy within the auto industry.

Background & Data: Michigan’s Manufacturing Edge

Data supports the claim that Detroit is leading this charge. According to the National Association of Manufacturers, Michigan manufacturing contributes significantly to the state’s total output, with a growing percentage attributed to advanced tech sectors rather than traditional assembly.

- R&D Spending: Michigan consistently ranks in the top tier for automotive R&D spending, with over 70% of the U.S. total occurring within the state.

- Job Growth: While traditional assembly jobs have seen fluctuations, roles in industrial engineering and CNC operation have seen steady demand growth over the last five years.

- Investment: Since 2020, billions in capital investment have been announced for EV and battery manufacturing plants in Michigan, all of which require advanced material supply chains.

The convergence of digital technology and physical manufacturing—often called Industry 4.0—is more visible in Detroit than perhaps anywhere else in North America. Sensors embedded in manufacturing equipment collect data to predict maintenance needs and optimize production flow, further solidifying the need for a tech-savvy workforce.

What Happens Next?

The future of Detroit advanced manufacturing looks robust, but it is not without competition. States in the American South are aggressively courting manufacturers with tax incentives. However, Detroit holds a strategic advantage: an ecosystem of suppliers, researchers, and logistics networks that has been refined over a century.

Looking ahead to 2030, experts predict that the integration of artificial intelligence into material discovery will accelerate. Instead of taking years to develop a new alloy, AI models running on supercomputers at local universities could identify promising compounds in weeks. Detroit is poised to be the physical location where these digital discoveries are turned into tangible products.

For the city, the stakes are high. Successfully leading the transition to advanced materials ensures that Detroit remains the global capital of mobility, not just as a heritage title, but as a living, breathing economic reality. As the lines between tech and industrial work blur, Detroit stands ready to define the next century of American making.