By Sarah Jenkins

Published: October 24, 2025

Location: Detroit, Michigan

Detroit Auto Industry Faces Crucial Turning Point as EV Strategies Shift in 2025

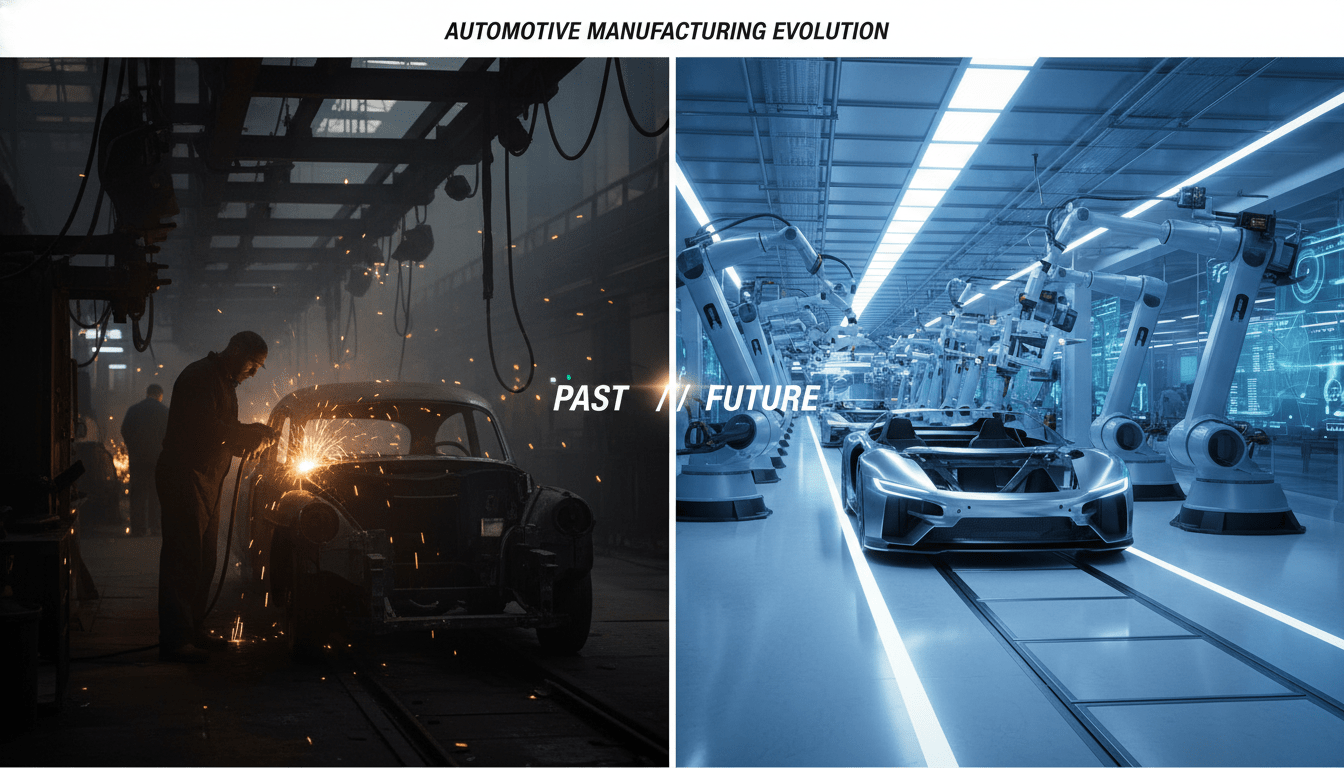

The heartbeat of the Motor City is finding a new rhythm this year. As 2025 progresses, the Detroit auto industry is navigating one of its most complex periods in recent history. Caught between aggressive electrification goals and a market that is demanding more flexible hybrid options, legacy automakers—General Motors, Ford, and Stellantis—are recalibrating strategies that will define the region’s economic landscape for the next decade.

For generations, Detroit has been the global epicenter of automotive innovation. Today, that title is being tested as new technology reshapes not just what vehicles are made, but how and where they are built. With billions of dollars in investments on the line, the implications for the local workforce and the broader Michigan economy are profound.

Retooling the Motor City: A Strategic Pivot

Earlier in the decade, the narrative was singular: an all-electric future was imminent. However, 2025 has brought a reality check to the Detroit auto industry. While the commitment to a zero-emissions future remains, the timeline and the path to get there have adjusted.

According to data from the Detroit Regional Chamber, automotive manufacturing output in Southeast Michigan remains strong, but the mix of vehicles is changing. Manufacturers are increasingly pivoting toward hybrid models as a bridge technology, responding to consumer concerns over charging infrastructure and vehicle costs.

"The transition isn’t a straight line; it’s a winding road," noted a representative from the Michigan Economic Development Corporation (MEDC) during a recent press briefing. "What we are seeing now is a pragmatic adjustment. Detroit’s automakers are ensuring they remain profitable today while building the infrastructure for tomorrow."

This strategic pivot is visible at plants like Factory ZERO and the assembly lines in Dearborn. The focus has shifted from purely ramping up EV volume to ensuring that supply chains—specifically battery production—are localized and resilient. This move is crucial for qualifying for federal incentives and protecting the industry from global supply shocks.

Impact on Detroit Residents and the Workforce

For the people of Detroit, these high-level corporate strategies translate directly into jobs and neighborhood stability. The Detroit auto industry remains the largest employer in the region, and changes on the assembly line ripple through the local economy.

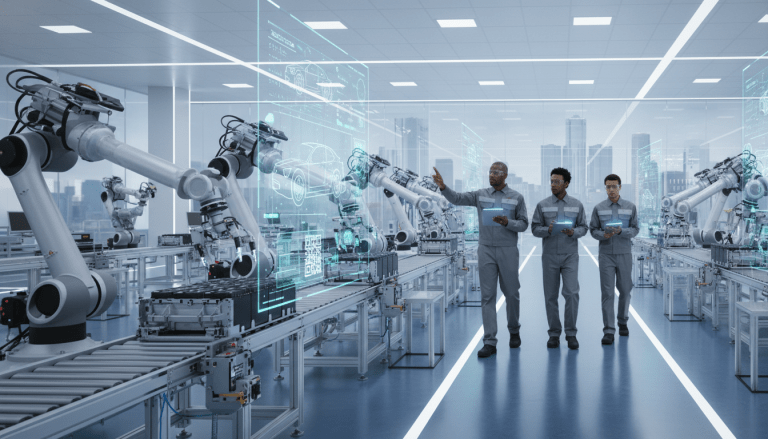

The shift requires a workforce with new skills. The United Auto Workers (UAW) has been vocal about ensuring that the transition to electric and hybrid vehicle production does not leave workers behind. Recent contract negotiations have solidified protections for workers at battery plants, historically a point of contention.

Local educational institutions are stepping up to bridge the gap. New training programs launched in partnership with Detroit trade schools are focusing on high-voltage systems and robotics maintenance. This ensures that Detroiters are the first in line for the high-tech manufacturing jobs replacing traditional mechanical assembly roles.

"We aren’t just building cars anymore; we are building computers on wheels," said Marcus Thorne, a floor manager at a Jefferson Avenue assembly plant. "For guys who have been on the line for 20 years, it’s a learning curve, but it’s also job security."

Background & Market Data

The significance of the automotive sector to Detroit’s GDP cannot be overstated. Reports indicate that for every job created in an auto assembly plant, approximately seven additional jobs are created in the supply chain and local service economy. This multiplier effect is vital for sustaining local businesses and restaurants surrounding industrial zones.

However, challenges persist. High interest rates have cooled vehicle purchasing nationwide, putting pressure on profit margins. Additionally, competition from non-unionized automakers in the South and international EV giants continues to threaten Detroit’s market share.

What Happens Next

Looking ahead, the remainder of 2025 will be characterized by "flexible manufacturing." Plants that can switch between internal combustion engines (ICE) and electric powertrains will be the most valuable assets.

For Detroit, the message is clear: adaptation is the only way forward. As the Detroit auto industry continues to evolve, the city’s ability to provide a skilled workforce and a supportive infrastructure will determine whether it remains the automotive capital of the world or becomes a relic of the past.