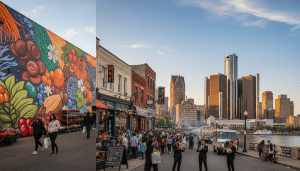

Detroit, long hailed as the manufacturing heartbeat of America, is undergoing a quiet but profound transformation. While the assembly lines that built the middle class still hum, they are increasingly being guided by algorithms, artificial intelligence, and real-time data analytics. The rise of the Detroit digital supply chain is reshaping how the region does business, insulating the automotive sector from global disruptions while creating a new tier of technological employment for local residents.

Following the severe supply chain shocks of the post-pandemic era, which saw parking lots across Southeast Michigan filled with unfinished trucks awaiting microchips, local industry leaders and government officials have pivoted toward resilience. The solution, according to experts, lies in digitizing the entire logistics network—from the raw material sources to the dealership floor.

Revolutionizing the Detroit Digital Supply Chain

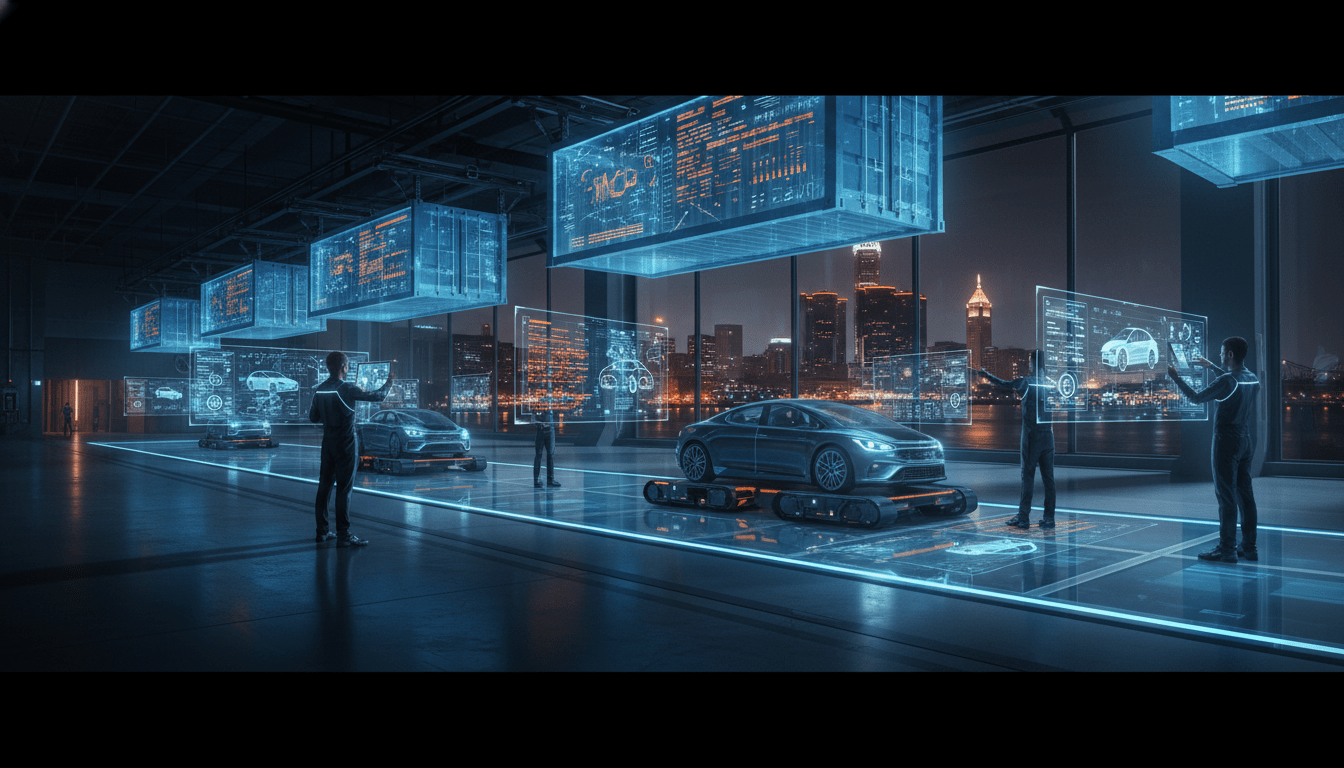

The shift toward Industry 4.0—the integration of smart digital technology into manufacturing—is not merely a trend but a survival strategy for Detroit’s automakers. Legacy companies and new startups alike are deploying “digital twins,” virtual replicas of physical supply chains that allow managers to predict bottlenecks before they occur.

According to the Michigan Economic Development Corporation (MEDC), the state is leveraging its heritage to become the “Global Epicenter of Mobility.” This designation goes beyond electric vehicles; it encompasses the complex digital infrastructure required to build them. By integrating blockchain for transparency and AI for demand forecasting, Detroit is attempting to bulletproof its economy against the kind of fragility exposed in recent years.

“We are seeing a convergence of IT and OT—information technology and operational technology,” said a representative from a Detroit-based logistics consultancy firm. “The goal is total visibility. If a shipment of parts is delayed in a port in Asia, a factory in Detroit should know instantly and automatically adjust its production schedule. That is the promise of the modern Detroit digital supply chain.”

Local initiatives are fueling this transition. Automation Alley, a World Economic Forum Advanced Manufacturing Hub based in the metro area, has been instrumental with initiatives like Project DIAMOnD (Distributed, Independent, Agile, Manufacturing On-Demand). This program aims to connect small and medium-sized manufacturers onto a shared digital network, allowing them to compete with global giants and pivot production rapidly during crises.

Impact on Detroit Residents and the Workforce

For the average Detroiter, the digitization of logistics might sound like high-level corporate strategy, but the on-the-ground impact is tangible. As supply chains become smarter, the nature of manufacturing jobs in the city is changing. The demand for manual labor is being supplemented—and in some cases replaced—by a high demand for data literacy, systems management, and technical maintenance.

This shift presents both a challenge and an opportunity for local workforce development. “New collar” jobs are emerging that require certification rather than four-year degrees, focusing on robotics programming and supply chain analytics. Local community colleges and training centers are increasingly tailoring curriculums to meet this specific need, offering a pathway to high-paying careers for residents who may not have traditional tech backgrounds.

Furthermore, a more efficient supply chain means a more stable local economy. When plants shut down due to parts shortages, hourly workers are often the first to feel the pain through temporary layoffs or reduced shifts. By stabilizing the flow of materials through digital tracking, automakers can maintain consistent production schedules, providing steadier paychecks for Detroit families.

Background & Data: The Cost of Disruption

The push for a robust Detroit digital supply chain is rooted in hard economic lessons. Data from the automotive industry indicates that the semiconductor shortage cost the global auto industry over $200 billion in lost revenue in 2021 alone, with a significant portion of that impact felt in Michigan. The inability to track tier-3 and tier-4 suppliers—the smaller companies that provide components to the main suppliers—was a primary failure point.

In response, major Detroit automakers are requiring deeper visibility into their supply networks. A recent survey of automotive supply chain executives revealed that over 70% plan to increase investment in digital supply chain technologies over the next three years. This investment is flowing directly into the Detroit metro area, attracting tech firms that specialize in logistics software to set up headquarters in the city.

The integration of 5G technology is also playing a pivotal role. With high-speed connectivity, factories can support thousands of sensors that track inventory in real-time. This technological bedrock is essential for the future of emerging technologies in the region, including autonomous trucking corridors which are currently being tested on Michigan highways.

What Happens Next for the Motor City?

As Detroit continues to secure its position as a tech-forward manufacturing hub, the definition of what it means to work in the auto industry is expanding. The Detroit digital supply chain is becoming a product in itself—a blueprint that other manufacturing cities are looking to emulate.

Looking ahead, the integration of sustainability metrics into these digital tools is the next frontier. Companies are not only tracking speed and cost but also carbon footprints, driven by both consumer demand and regulatory pressure. Detroit’s ability to master this complex web of data will determine its competitiveness for the next half-century.

While challenges remain regarding cybersecurity and workforce upskilling, the momentum is undeniable. The Motor City is rapidly becoming the Motion City, where data moves just as fast as the vehicles rolling off the line.