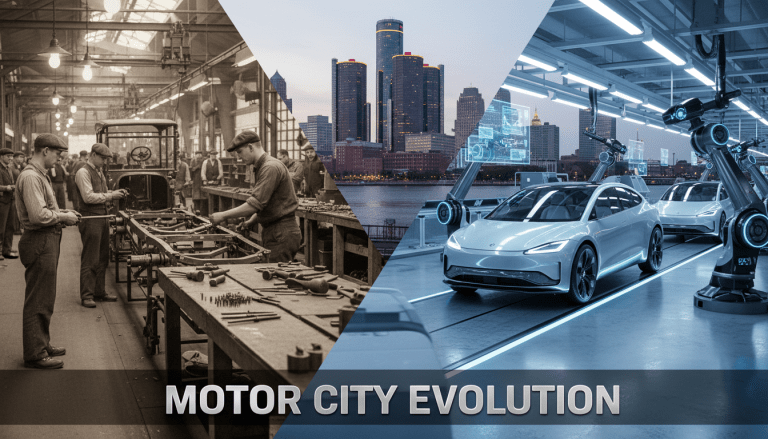

Detroit, historically recognized as the beating heart of the global automotive industry, is currently undergoing one of its most significant transformations in a century. As the world pivots toward sustainable transportation, Detroit electric vehicle production has become the central focus for the region’s economic roadmap. Major automakers, including General Motors and Ford, are investing billions into retooling historic facilities, yet the transition is proving to be complex, influenced by fluctuating market demands and logistical challenges.

For decades, the rhythm of Detroit was set by the internal combustion engine. Today, that rhythm is being recalibrated to the hum of battery-powered drivetrains. The stakes are high for the city, the workforce, and the legacy of American manufacturing. While the vision of an all-electric future remains the long-term goal, recent months have seen automakers adjusting their strategies to match consumer adoption rates, creating a dynamic and evolving landscape for local industry.

The State of Manufacturing in the Motor City

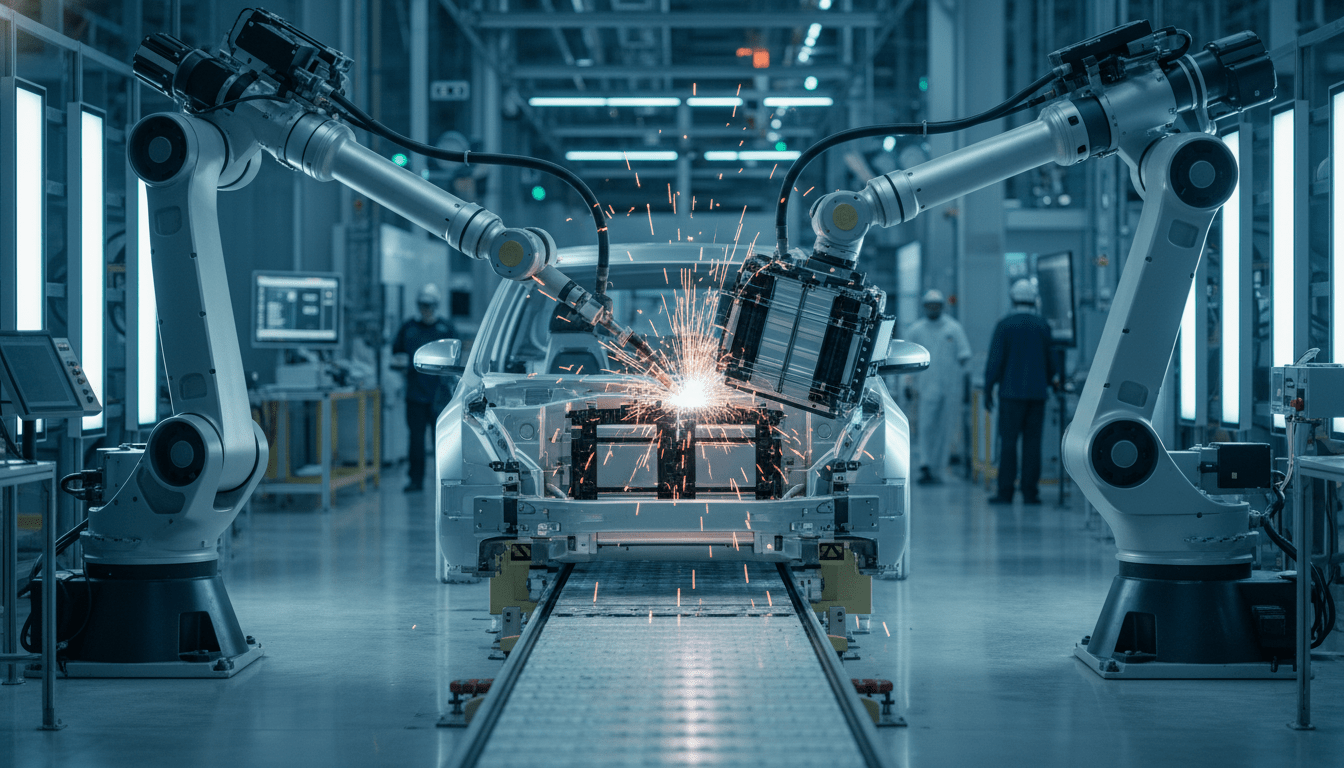

The push for Detroit electric vehicle production is visible across several key sites in the metro area. Perhaps the most prominent symbol of this shift is General Motors’ Factory ZERO. Straddling the border of Detroit and Hamtramck, this facility—formerly the Detroit-Hamtramck Assembly Center—was completely renovated with a $2.2 billion investment to become the launchpad for GM’s multi-brand EV strategy. It is currently the home of the GMC Hummer EV and the Chevrolet Silverado EV.

Similarly, the Ford Rouge Electric Vehicle Center in Dearborn represents a marriage of heritage and high-tech. Producing the F-150 Lightning, this facility has been a testbed for scaling electric truck production. However, the road has not been entirely smooth. According to reports from the Michigan Economic Development Corporation and industry analysts, while production capacity has increased, automakers have recently had to scale back aggressive output targets due to softer-than-expected consumer demand in late 2024 and early 2025.

“The transition to electric vehicles was never going to be a linear line upward,” noted a recent briefing from automotive industry analysts at Cox Automotive. “Detroit is currently in a calibration phase, balancing the immense capital investment of retooling plants with the reality of current interest rates and consumer purchasing power.”

Impact on Detroit Residents and the Workforce

For the people of Detroit, the rise of electric vehicle manufacturing is about more than just new car models; it is fundamentally about jobs and economic stability. The United Auto Workers (UAW) has been vocal about ensuring that the transition to EVs does not leave workers behind. Unlike traditional engines, electric powertrains require fewer parts and, theoretically, less labor to assemble. This has created anxiety among the local workforce regarding long-term job security.

However, the shift is also creating new opportunities. Battery assembly and software integration are becoming critical skills. Local initiatives and partnerships between automakers and educational institutions are ramping up to retrain workers. The focus is shifting from mechanical assembly to electro-mechanical maintenance and high-tech manufacturing roles.

Local business owners in the supply chain are also feeling the ripple effects. Tier-one and tier-two suppliers in the metro Detroit area are having to pivot their own production lines—moving away from pistons and fuel injectors toward heat pumps, battery casings, and electric motors. This diversification is crucial for the survival of the broader Detroit electric vehicle production ecosystem.

Market Headwinds and Strategic Pivots

Despite the optimism surrounding the “EV revolution,” 2024 and 2025 have served as a reality check. High interest rates and vehicle prices have slowed the mass adoption of EVs, prompting Detroit automakers to adjust their timelines. For instance, several planned battery plant expansions have been paused or rescheduled as companies reassess the market.

This cooling effect has led to a renewed interest in hybrid vehicles. Both Ford and GM have signaled that hybrids will play a more significant bridge role than previously anticipated. For Detroit factories, this means a need for flexibility—manufacturing lines that can handle both pure EVs and hybrid configurations to maintain steady employment and output.

Data from the U.S. Energy Information Administration suggests that while EV market share is growing, the trajectory is stabilizing rather than skyrocketing. For Detroit, this means the rush to retool every factory immediately has slowed, allowing for a more calculated approach to infrastructure development.

Infrastructure and the Road Ahead

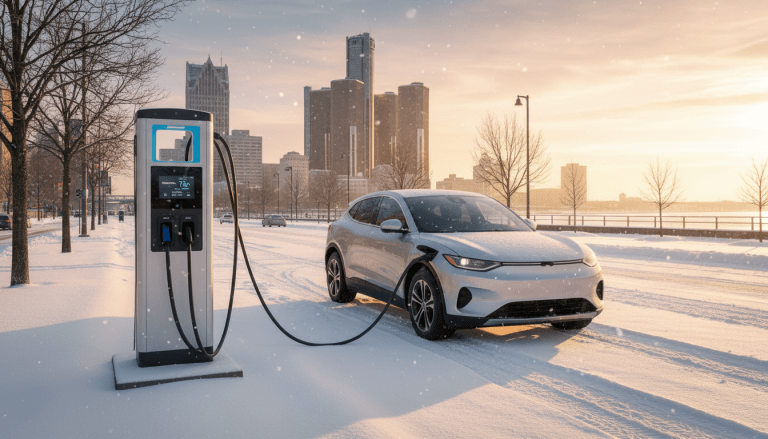

Production is only half the battle; the cars need somewhere to charge. The City of Detroit, in collaboration with state and federal partners, is working to expand charging infrastructure. This is critical not just for selling cars to other states, but for encouraging local adoption. The expansion of charging networks creates construction and maintenance jobs, further embedding the EV economy into the city’s fabric.

Looking forward, the development landscape in Detroit will continue to be shaped by how successfully the Big Three can navigate this transition. The commitment to keeping production in Michigan remains strong, driven by tax incentives and a deep talent pool.

“Detroit has reinvented itself before, and it is doing so again,” said local economic historian Dr. Marcus Thorne. “The move to electric vehicle production is as significant as the introduction of the assembly line itself. It will take time, and there will be friction, but the infrastructure is being laid for the next fifty years of the automotive industry right here.”

What Happens Next?

As we move deeper into 2025, residents and industry watchers should keep an eye on upcoming contract negotiations and federal policy shifts. The regulatory environment regarding emissions standards will heavily influence how quickly Detroit automakers push fully electric lineups versus hybrids.

For now, Detroit electric vehicle production remains a complex, high-stakes endeavor. It serves as a barometer for the region’s economic health, signaling that while the Motor City is changing, it has no intention of relinquishing its title as the automotive capital of the world.