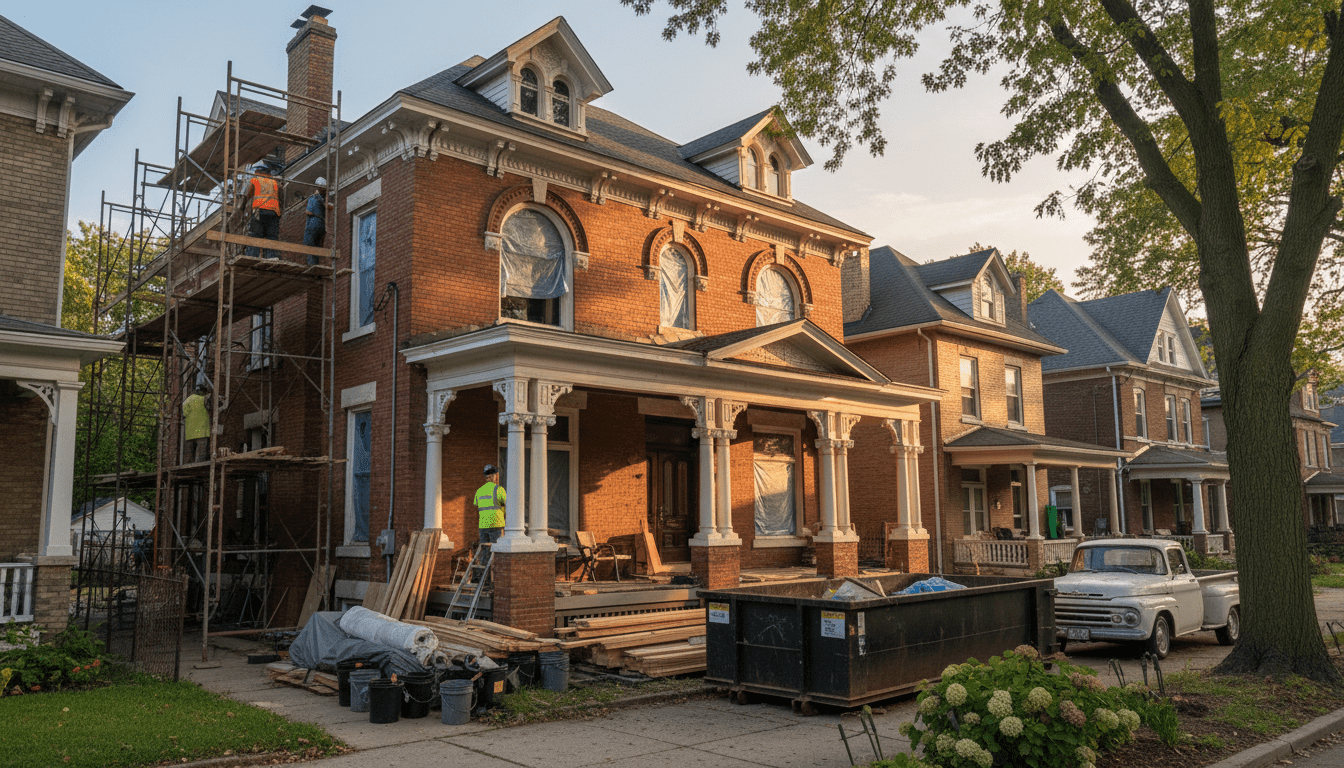

For nearly a decade, the narrative surrounding Detroit real estate has been dominated by the allure of the low-cost auction house—historic properties available for the price of a used car, awaiting a visionary owner to restore them. However, as 2024 progresses, the landscape for Detroit fixer-upper homes is shifting dramatically. Rising construction costs, fluctuating interest rates, and a maturing inventory at the Detroit Land Bank Authority (DLBA) are forcing prospective buyers and local officials to rethink the economics of rehabilitation.

While opportunities for equity building remain, the era of the easy flip appears to be waning. New data suggests that while demand remains steady in stabilizing neighborhoods, the "appraisal gap"—the difference between the cost to renovate a home and its post-renovation market value—remains a significant hurdle for traditional financing.

The Current State of Inventory and Pricing

The inventory of available distressed properties is changing. According to recent reports from the Detroit Land Bank Authority, the agency has successfully sold thousands of structures over the last ten years, significantly reducing the number of salvageable homes in its inventory. What remains often requires more intensive structural work compared to the cosmetic fixers available five years ago.

Local contractors report that the cost of materials and labor has surged. "Three years ago, a full window package for a standard colonial in Russell Woods might have cost $12,000. Today, you are looking closer to $18,000 or $20,000," noted a project manager with a Detroit-based general contracting firm. These rising hard costs directly impact the viability of Detroit fixer-upper homes for entry-level buyers who lack significant cash reserves.

Despite these challenges, sales volumes in specific pockets of the city remain resilient. Neighborhoods like Bagley, Fitzgerald, and East English Village continue to see robust activity, where the gap between renovation costs and final appraisal values is narrowing.

The Appraisal Gap Challenge

One of the most persistent issues facing the market for Detroit fixer-upper homes is the appraisal gap. In many Detroit neighborhoods, a home might be purchased for $50,000 and require $100,000 in renovations. However, if comparable sales (comps) in the area only support a value of $120,000, a bank will not lend the full amount needed for the project. This leaves the buyer with a $30,000 shortfall to cover in cash.

This economic reality has spurred the City of Detroit and various financial partners to develop specialized loan products. Programs like the Detroit Home Mortgage and tighter collaborations with FHA 203(k) lenders aim to bridge this divide. Yet, utilization rates for these complex financial products remain lower than traditional mortgages due to the rigorous contractor requirements and paperwork involved.

According to data analyzed by local housing non-profits, cash buyers—often out-of-state investors or LLCs—still dominate the acquisition of distressed properties. This trend can crowd out owner-occupants who rely on financing, further complicating neighborhood revitalization efforts aimed at increasing homeownership rates.

Impact on Detroit Residents

The shifting market for Detroit fixer-upper homes has complex implications for long-time residents. On one hand, the successful renovation of a blight-stricken home improves street safety, increases property values for neighbors, and signals investment. The elimination of dangerous, vacant structures is a universal goal for community block clubs.

However, there is distinct anxiety regarding affordability. As the cost of entry for fixer-uppers rises, long-time renters looking to buy in their own neighborhoods find themselves priced out not by the purchase price, but by the rehabilitation budget required to make the home habitable.

"We want the blight gone, absolutely," said a resident of the grandmont Rosedale area during a recent community meeting. "But we also want to ensure that the families who stuck it out through the hard times have a shot at these houses, not just investors looking for a rental portfolio."

Furthermore, as property values rise following successful renovations, existing residents face the prospect of increased property tax assessments. While the City has implemented measures to protect legacy homeowners, the fear of displacement due to tax burden remains a palpable concern in rapidly appreciating districts.

Navigating Land Bank Compliance

For those brave enough to take on a project, the regulatory environment is strict. Buyers of DLBA properties enter into a compliance agreement requiring them to bring the property up to code within six to nine months. Failure to do so can result in the property reverting to the Land Bank.

Recent shifts in policy have seen the DLBA working to be more communicative with buyers, but the timeline remains aggressive for novices. The City of Detroit Housing & Revitalization Department has emphasized the importance of buyers having a clear scope of work and confirmed financing before signing a purchase agreement. The days of buying a house on a credit card and fixing it on weekends are largely over; the current market demands professional project management and capitalized buyers.

Future Outlook for Renovation Projects

Looking ahead to the remainder of 2024 and into 2025, the market for Detroit fixer-upper homes is expected to stabilize but remain expensive regarding construction costs. Industry experts predict that inventory will continue to tighten as the DLBA exhausts its supply of structurally sound homes, eventually leaving mostly demolition-candidates remaining.

This scarcity may drive demand toward the private market—homes sold by individuals rather than the city—where prices are generally higher but title issues may be less complex. For the Detroit real estate ecosystem, this transition from a public-inventory-dominated market to a private market is a sign of normalization.

For potential buyers, the advice from housing counselors is clear: Do not underestimate the budget. A contingency fund of 20% to 30% above the estimated renovation cost is now considered standard to handle the unforeseen structural issues common in homes built before 1950. As the city continues its path of recovery, the economic landscape of homeownership is evolving from a story of low-cost entry to one of strategic, long-term investment.