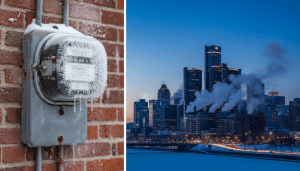

For thousands of homeowners across the Motor City, the annual arrival of property assessment notices brings a mix of anticipation and anxiety. However, recent data suggests a stabilizing and increasingly positive trend for the local housing market. As the City of Detroit continues its economic recovery, the average Detroit home value estimate is seeing significant gains, marking a turning point for long-term residents looking to build generational wealth.

According to recent figures released by the City of Detroit Office of the Assessor, residential property values have climbed steadily over the past several years. This upward trajectory is not limited to the revitalized downtown corridor or the historic districts of Indian Village and Palmer Woods; it is beginning to permeate middle-class neighborhoods that saw stagnation for over a decade. The shift represents a crucial moment for the city’s housing ecosystem, moving from a landscape defined by foreclosure to one defined by appreciation.

The Gap Between Assessment and Market Reality

Understanding the current real estate climate requires distinguishing between the assessed value for tax purposes and the actual market value—what a buyer is willing to pay. For years, a disconnect existed where tax assessments were criticized for being higher than the realistic sales price of homes in distressed neighborhoods. However, the gap is narrowing as market prices catch up to and exceed assessments.

Data indicates that the median sales price in Detroit has risen year-over-year. As reported in our previous coverage of Detroit neighborhood revitalization projects, targeted investment in blight removal and infrastructure has directly correlated with these rising property values. When a homeowner seeks a professional Detroit home value estimate today, they are increasingly likely to find that their asset is worth more than it was just 24 months ago.

“The market is responding to stability,” said a local real estate analyst familiar with Wayne County trends. “We aren’t seeing the speculative bubble of the mid-2000s. Instead, we are seeing incremental, sustainable growth driven by genuine demand and a shortage of move-in ready inventory.”

Impact on Detroit Residents

For the average Detroit resident, rising home values are a double-edged sword. On one hand, increased equity provides financial security and the ability to secure home improvement loans. On the other, it raises concerns regarding property taxes.

Mayor Mike Duggan’s administration has repeatedly emphasized that under Michigan state law, taxable value is capped at the rate of inflation (typically around 5%) or the consumer price index, whichever is lower, as long as the property has not changed hands. This proposal aims to protect longtime residents from being priced out of their homes due to rapid appreciation.

“Homeowners need to understand that a higher Detroit home value estimate on the open market does not automatically equate to a massive spike in their tax bill immediately, thanks to the taxable value cap,” noted a spokesperson for a local housing advocacy group. “However, for new buyers entering the market, the reset of taxable value upon transfer remains a critical factor in affordability.”

Furthermore, the Detroit property tax appeals process remains a vital tool for residents who believe their city assessment does not reflect the true condition of their property. Officials urge residents to review their assessment notices carefully and utilize the Board of Review if discrepancies exist.

Data and Neighborhood Trends

According to the City of Detroit Office of the Assessor, the most recent assessment cycles have shown value increases in nearly all of the city’s neighborhoods. This is a stark contrast to a decade ago when values were in decline across the board.

Key statistics highlight this resurgence:

- Inventory Shortage: A lack of renovated, move-in-ready homes is driving up competition and prices.

- Appraisal Gaps: While narrowing, appraisal gaps remain a challenge in some areas, where the cost to renovate exceeds the current appraised value, though this margin is shrinking.

- Sales Volume: The volume of cash transactions is slowly decreasing in favor of traditional mortgages, signaling a healthier, more traditional housing market.

Federal Reserve data and reports from the University of Michigan regarding Detroit’s economic outlook suggest that while the city is not immune to national interest rate fluctuations, the low cost of entry relative to other major metros keeps Detroit attractive.

What Happens Next

Looking toward the next fiscal year, experts predict a continued, albeit more moderate, rise in home values. The focus for city planners is now shifting toward the proposed Land Value Tax plan, which aims to cut taxes on structures while increasing taxes on land. If implemented, this could significantly alter how a Detroit home value estimate is calculated in relation to tax liabilities, potentially spurring further development on vacant lots.

For now, Detroit homeowners are in a stronger position than they have been in years. The narrative is shifting from survival to growth, and for the first time in a generation, the equity in a Detroit home is becoming a reliable financial cornerstone for families across the city.