For decades, Detroit property taxes have been a contentious subject, often cited as a barrier to homeownership and a hurdle for local economic development. As the city continues its revitalization efforts in 2024, the debate surrounding the proposed Land Value Tax (LVT) plan remains central to the conversation. While the proposal aims to drastically reduce bills for homeowners while increasing costs for vacant land speculators, its legislative path has been anything but smooth.

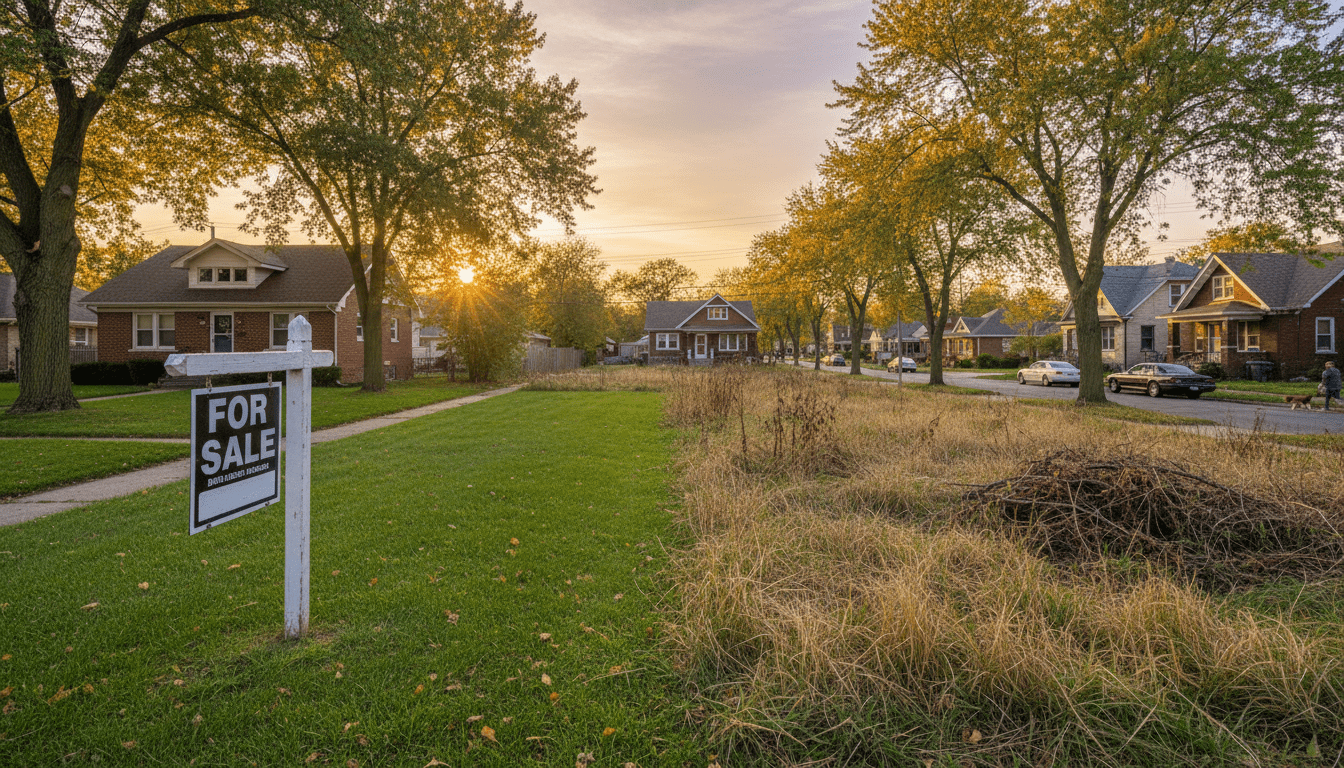

Mayor Mike Duggan’s administration has spent much of the last year campaigning for what would be the most significant overhaul of the city’s tax code in a generation. The core issue, according to city officials, is that the current system disincentivizes development by taxing improvements on buildings at the same high rate as land. This structure has historically allowed speculators to sit on vacant lots with low carrying costs while homeowners face some of the highest effective tax rates in the nation.

The Land Value Tax Proposal Explained

The proposed plan, often referred to as a “split-rate” tax, seeks to shift the tax burden. Under the new model, taxes on the assessed value of structures (homes, buildings) would decrease, while the tax rate on land itself would increase significantly. According to the City of Detroit, this shift is designed to reward residents who maintain their properties and penalize those who leave land blighted or undeveloped.

“The current system punishes you for building on your land and rewards you for doing nothing with it,” Mayor Duggan stated during a series of town hall meetings promoting the plan. Official projections from the City of Detroit suggest that nearly 97% of residential homeowners would see a tax cut if the legislation is implemented, with an average reduction of 17%.

However, the plan requires authorization from the state legislature before it can be put to a vote by Detroit residents. While the bills passed the Michigan House Local Government Committee, they stalled in the full House late last year due to concerns regarding the complexity of the tax implementation and potential legal challenges.

Impact on Detroit Residents and Neighborhoods

For the average Detroiter, property taxes are more than just a financial obligation; they are a key factor in housing stability. Detroit has faced a legacy of over-assessment, particularly between 2010 and 2016, which contributed to a wave of tax foreclosures. While the assessment process has improved significantly in recent years under the oversight of the State Tax Commission, the millage rate remains high compared to neighboring suburbs.

If the Land Value Tax were to eventually pass, the impact on neighborhoods could be substantial. Residents in areas like Detroit’s developing neighborhoods would likely see immediate relief on their annual tax bills. For a home assessed at $50,000, a 17% reduction represents hundreds of dollars in annual savings—money that can be reinvested into home repairs or local businesses.

Conversely, owners of vacant lots and scrap yards would face a steep increase. The objective is to force these owners to either develop the land, sell it to someone who will, or face carrying costs that make holding onto blight financially unviable. Local community groups have expressed cautious optimism, though some worry about the potential for rent increases if landlords pass on land-tax costs, despite the proposed reduction in building taxes.

Historical Context and Data

To understand the urgency of reform, one must look at the data. Detroit currently levies a total millage rate of approximately 69 to 80 mills depending on the specific district and overlays, significantly higher than the national average. This high rate depresses property values because the tax burden is capitalized into the home price.

According to research supported by the Lincoln Institute of Land Policy, split-rate taxation has been used successfully in Pennsylvania cities to spur development. In Detroit, the disparity is stark. Data from the Detroit Assessment Division shows that vacant land is often taxed at a nominal rate compared to its potential market value, creating an arbitrage opportunity for speculators.

Furthermore, the legacy of the foreclosure crisis looms large. A study by the Coalition for Property Tax Justice highlighted that thousands of Detroiters were foreclosed upon due to illegally inflated tax assessments. While the city has since corrected its assessment methodologies, trust in the system remains fragile. Any new reform must not only be economically sound but also administratively transparent to regain the confidence of the populace.

The Current Assessment Cycle

While the Land Value Tax remains in legislative limbo, the standard assessment cycle continues. Earlier this year, the City Assessor completed the re-evaluation of residential and commercial properties. Unlike the chaotic years of the past, the 2024 assessments were largely met with acceptance, driven by rising property values across the city. As the Detroit real estate market trends upward, assessments follow.

However, rising values mean rising taxable values (capped at the rate of inflation or 5%, whichever is lower, for existing owners). For new buyers uncapped by the Headlee Amendment, the sticker shock of Detroit property taxes remains a barrier to entry, further emphasizing the need for structural reform.

What Happens Next?

The future of Detroit property taxes lies in Lansing. Supporters of the Land Value Tax are expected to renew their push during the legislative sessions in late 2024 and 2025. Without state enabling legislation, Detroit cannot legally decouple the tax rate for land and buildings.

For now, residents are advised to pay close attention to their annual assessment notices mailed in January and February. The appeals window—the March Board of Review—remains the only current mechanism for homeowners to contest the assessed value of their property if they believe it exceeds 50% of the true market value. As the city waits for a legislative breakthrough, the status quo remains a delicate balance of rising values and heavy tax burdens.