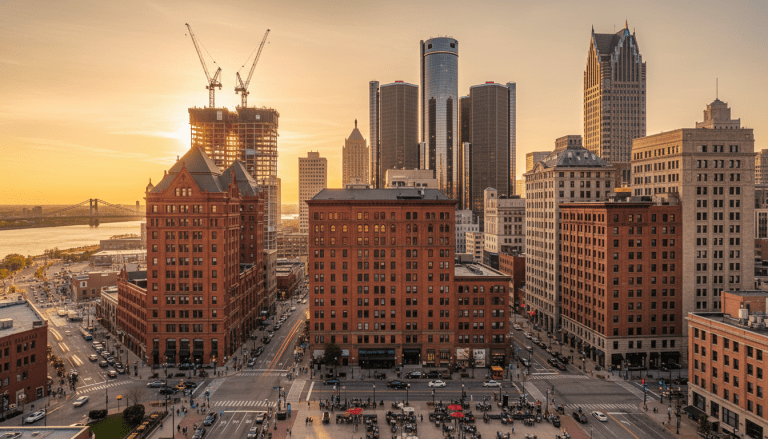

In the decade following Detroit’s historic municipal bankruptcy, the city’s skyline and street-level landscape have undergone a transformation that many urban planners describe as unprecedented. While the headlines often focus on the gleaming towers rising downtown or the renovation of iconic structures like Michigan Central Station, the financial engine driving much of this development is less visible but equally critical: Detroit public-private partnerships.

These collaborations, often referred to as P3s, have become the primary vehicle for large-scale economic development in Southeast Michigan. By leveraging public tax incentives to attract private capital, city leaders argue that they are jumpstarting projects that would otherwise be financially unfeasible. However, as billions of dollars flow into these ventures, the conversation among residents and policymakers is shifting toward accountability and the tangible benefits for long-time Detroiters.

According to data from the Detroit Economic Growth Corporation (DEGC), billions in private investment have been secured over the last several years through development deals that utilize tax abatements, land transfers, and infrastructure grants. This model has effectively reshaped the central business district, but the implications for neighborhood equity remain a hot topic of debate.

The Mechanics of Collaboration

Public-private partnerships in Detroit generally function by bridging the gap between the cost of construction and the market value of the completed project—a gap that has historically stifled development in the city. Private developers, such as Bedrock or Olympia Development of Michigan, propose large-scale projects, while public entities like the City of Detroit, the Downtown Development Authority (DDA), or the Michigan Strategic Fund provide financial tools to make the math work.

These tools often take the form of Tax Increment Financing (TIF). Under a TIF arrangement, the additional property tax revenue generated by a new development is captured and reinvested into the project itself—often to pay for infrastructure or environmental remediation—rather than going immediately into the general fund.

“Without these incentives, the cost of building in Detroit simply exceeds the rental rates or sales prices the market can currently support,” noted a representative from a local economic development agency in a recent briefing. “The public sector participation reduces the risk for lenders and investors, making these transformative projects possible.”

A prime example of this mechanism is the Detroit Economic Growth Corporation‘s management of various development authorities. Their reports indicate that for every dollar of public investment, the city aims to attract multiple dollars in private spending, theoretically creating a multiplier effect that boosts the local economy.

Impact on Detroit Residents

For the average resident, the success of Detroit public-private partnerships is measured not in the height of skyscrapers, but in jobs, affordable housing, and neighborhood stability. This disconnect has led to the creation and enforcement of the Community Benefits Ordinance (CBO).

Passed by voters in 2016 and subsequently amended, the CBO requires developers seeking significant tax breaks or public land transfers to engage with a Neighborhood Advisory Council. This process is designed to ensure that the community secures specific commitments, such as hiring local contractors, funding workforce training programs, or reserving units for affordable housing.

For instance, the massive $1.5 billion District Detroit expansion, a partnership involving the Ilitch organization and Related Companies, triggered the CBO process. The resulting benefits package included millions in funding for rental assistance and home repairs for residents in the immediate vicinity.

However, skepticism remains. Local business owners in areas like Midtown and Corktown have expressed mixed feelings. While increased foot traffic from new developments helps retail and dining establishments, rising property values can lead to displacement. “We see the new buildings going up, and we see the press releases about jobs,” said one longtime Cass Corridor business owner. “But we need to make sure those construction contracts and permanent jobs are actually going to people who stayed in the city during the hard times.”

For more on how local commerce is adapting, read our coverage on Detroit local business trends and the evolving landscape of Detroit real estate.

Background & Data: The Scale of Investment

To understand the sheer scale of these partnerships, one must look at the recent major developments. The University of Michigan Center for Innovation, currently under construction, represents a significant collaboration involving the state, the city, and private donors. This project is positioned not just as a building, but as a talent pipeline intended to attract tech companies to the region.

According to U.S. Census Bureau data, Detroit has seen a stabilization in its population decline, a metric city officials attribute partly to increased economic opportunity driven by these development projects. Yet, the data also highlights the persistent income inequality that P3s are often criticized for failing to address adequately.

- The Hudson’s Site: A landmark project by Bedrock, heavily supported by transformational brownfield tax incentives.

- Michigan Central: Ford Motor Company’s restoration of the train station involved significant public infrastructure coordination to create a mobility hub.

- Affordable Housing: City mandates often require that 20% of residential units in taxpayer-subsidized projects be reserved for residents earning 80% or less of the Area Median Income (AMI).

Critics argue that “affordable” based on the regional AMI is still out of reach for many Detroiters, whose median household income is significantly lower than the suburban average. This statistical reality is a constant point of friction during City Council hearings regarding new tax abatements.

What Happens Next

As 2025 progresses, the model for Detroit public-private partnerships is likely to evolve. There is growing political pressure to shift incentives away from downtown mega-projects and toward neighborhood commercial corridors. The Strategic Neighborhood Fund, which pools public and private philanthropic dollars to revitalize areas like Livernois-McNichols and Southwest Detroit, offers a blueprint for this decentralized approach.

City officials are also placing a heavier emphasis on compliance. Ensuring that developers actually hit their hiring targets and deliver the promised community benefits is becoming a priority for the City Council. If the enforcement mechanisms tighten, future P3s may come with stricter strings attached, prioritizing social returns alongside financial ones.

Ultimately, the synergy between the public sector and private enterprise will remain the dominant narrative in Detroit’s economic story. The challenge ahead lies in balancing the need for aggressive growth with the imperative of inclusive development that leaves no neighborhood behind.