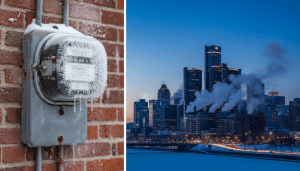

The landscape of the Detroit rental property market is undergoing a significant transformation as 2024 progresses, driven by a collision of rising market demand and an intensified regulatory crackdown by municipal authorities. For years, Detroit has been characterized as a city of homeowners, but recent data confirms a shift toward a majority-renter population, creating new dynamics for landlords, investors, and long-time residents.

As property values in the city continue to appreciate, the cost of renting has followed suit. However, the most pressing story for stakeholders in the Detroit housing sector is not just the price, but the rigorous enforcement of compliance codes that is reshaping who can operate in the city.

Strict Compliance Standards Reshaping the Market

According to the City of Detroit’s Buildings, Safety Engineering, and Environmental Department (BSEED), the push to bring rental properties up to code is no longer optional. The city has ramped up its enforcement of the Rental Registration and Inspection Ordinance, which requires landlords to obtain a Certificate of Compliance to legally collect rent.

“The goal is tenant safety, plain and simple,” a representative from BSEED stated in a recent public briefing. “We are moving past the era where non-compliant rentals are tolerated. Every Detroiter deserves a lead-safe, code-compliant home.”

This enforcement creates a complex scenario for the Detroit rental property ecosystem. While tenant advocates applaud the moves as necessary protections against “slumlords” who have long neglected maintenance, small-scale landlords argue that the cost of compliance—specifically lead abatement—is prohibitive. Data from local housing advocacy groups suggests that thousands of units remain unregistered, leaving them in a legal gray area where tenants may withhold rent into escrow accounts until repairs are made.

For more on how these regulations are influencing local construction, read our coverage on neighborhood development projects across the city.

Impact on Detroit Residents

For the average tenant, the tightening of the Detroit rental property supply has immediate financial consequences. As landlords invest heavily to meet city codes, those costs are frequently passed down in the form of higher monthly rents. This phenomenon is most visible in the Greater Downtown area, but is increasingly rippling out into neighborhoods like Bagley, Fitzgerald, and East English Village.

A recent report by Detroit Future City highlights the growing affordability gap. The report indicates that while the supply of quality rentals is slowly increasing, it is not keeping pace with the needs of low-to-moderate-income residents. Many Detroiters are now spending more than 30% of their income on housing, classifying them as cost-burdened.

Local resident and housing organizer Marcus Thrive told DetroitCityNews.com, “It’s a double-edged sword. We finally have the city forcing repairs, which we needed. But now, the rent for a three-bedroom house that used to be $800 is jumping to $1,200 because the landlord put in new windows and certified the property. People are being priced out of the very homes that are finally being fixed.”

Background & Data: A Majority-Renter City

Context is vital to understanding the magnitude of these changes. According to data from the U.S. Census Bureau, Detroit’s homeownership rate has hovered near or below 50% in recent years, solidifying its status as a majority-renter city. This demographic shift places immense importance on the regulation of the rental stock.

The inventory varies wildly. The market is split between high-end, renovated units in the city center and aging single-family homes in the outer neighborhoods. Investors from outside the state—and often outside the country—purchased large portfolios of Detroit rental property assets following the bankruptcy. Now, the city is tasked with holding these remote owners accountable.

The City of Detroit’s BSEED portal shows a steady uptick in rental registrations over the last 12 months, suggesting that the enforcement measures are working, albeit slowly. However, the backlog of inspections remains a logistical hurdle.

Economic Implications and Future Outlook

Looking ahead, the economic model for owning rental property in Detroit is shifting. The administration is currently advocating for a Land Value Tax plan, which would reduce taxes on structures and increase taxes on land. If passed, this could theoretically lower the tax burden for landlords who maintain and improve their buildings, while penalizing speculators who sit on vacant land or blighted properties.

This potential policy shift was a key topic during the City Council’s latest budget considerations. Proponents argue it will spur development and lower costs for compliant landlords, potentially stabilizing rents.

“We are at a pivot point,” says Dr. Sarah Jenkins, an urban planning researcher at a local university. “The wild west days of buying a Detroit house for $5,000 and renting it out without repairs are over. The market is maturing, but the transition period is painful for renters with fixed incomes and small landlords lacking capital.”

As 2024 continues, the balance between enforcing safety standards and maintaining affordability will remain the central tension in the Detroit housing narrative.