Detroit’s economic narrative has long been dominated by the automotive industry, but a quiet revolution is taking place in boardrooms, co-working spaces, and innovation hubs across the city. As 2025 progresses, Detroit startup funding is seeing a strategic shift, moving beyond traditional manufacturing roots into a diverse ecosystem of tech, mobility, and sustainable innovation. New data suggests that while coastal venture capital markets tighten, the Great Lakes region—and Detroit specifically—is becoming a stabilizing force for early-stage investment.

The flow of capital into the city is no longer just about keeping lights on; it is about scaling ideas that originated in local neighborhoods. From the bustling corridors of the Michigan Central innovation district to the grassroots incubators in Midtown, the funding landscape is evolving to support a broader range of entrepreneurs. This influx of capital is critical for the city’s goal to retain talent and diversify its tax base.

The Current State of Capital in Detroit

According to recent reports from the Michigan Venture Capital Association (MVCA), the state has maintained a resilient posture regarding venture capital availability, with Detroit serving as the primary hub for activity. While national trends showed a cooling period in late 2023 and 2024, Detroit’s ecosystem has benefited from a mix of private venture capital, philanthropic grants, and state-backed initiatives.

Analysts point to a “hybrid funding model” unique to Detroit. Unlike Silicon Valley, where private equity dominates, Detroit’s innovation engine is heavily fueled by public-private partnerships. The Michigan Economic Development Corporation (MEDC) has continued to deploy funds through the State Small Business Credit Initiative (SSBCI), which aims to leverage private capital for high-growth potential companies.

“We are seeing a maturation of the Detroit market,” said a representative from a local angel investor group during a recent economic forum. “Five years ago, we were funding concepts. Today, we are funding scaling operations. The questions from investors have shifted from ‘Is this possible?’ to ‘How fast can this grow in Detroit?'”

Michigan Central and the Mobility Magnet

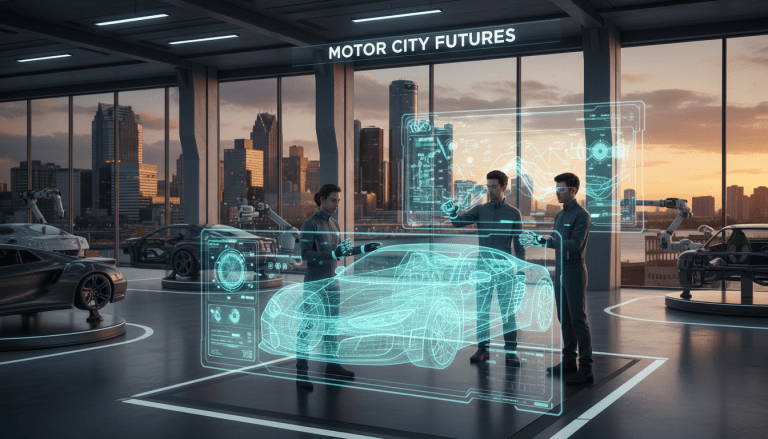

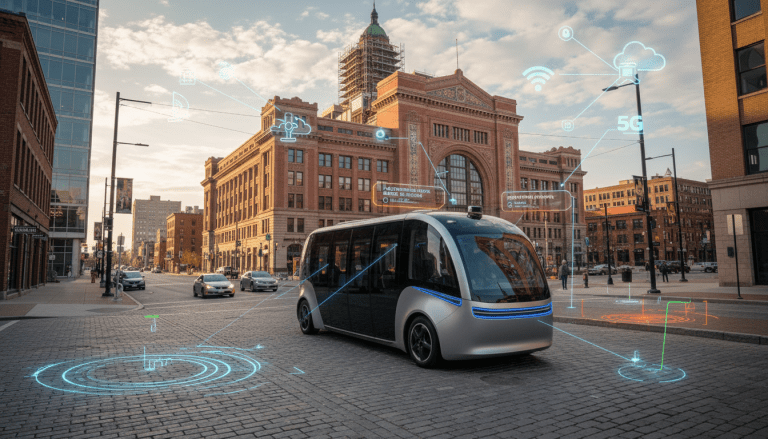

A significant portion of the recent Detroit startup funding surge can be attributed to the gravitational pull of Michigan Central. Ford Motor Company’s restoration of the train station and the surrounding district has created a physical epicenter for mobility startups. This concentration of talent has attracted investors specifically looking for “mobility-adjacent” technologies—software, sensors, and clean energy solutions that support the auto industry.

This district does more than just house companies; it acts as a validator. When a startup secures space and pilot programs within the district, it signals to venture capitalists that the technology has a practical application. This “proof of concept” environment is reducing risk for investors, leading to larger seed rounds and Series A investments for local firms.

However, the funding isn’t strictly limited to mobility. Fintech and healthtech sectors in Detroit are also reporting upticks in interest, driven by the city’s proximity to major hospital systems and a growing need for digital financial inclusion tools.

Impact on Detroit Residents and Neighborhoods

For the average Detroiter, headlines about millions in venture capital can seem abstract. However, the downstream effects of robust Detroit startup funding are tangible. The primary impact is job creation in sectors that offer higher-than-average wages. As startups scale, they require not just software engineers, but sales staff, operations managers, HR professionals, and customer support teams.

Local workforce development agencies are increasingly partnering with funded startups to ensure these roles are filled by Detroit residents. Programs focused on digital upskilling are becoming essential bridges between the funding news and the neighborhood economy.

Furthermore, there is a concerted effort to ensure capital reaches diverse founders. Historically, venture capital has struggled with equitable distribution. In Detroit, organizations like the New Economy Initiative and TechTown Detroit are working to ensure that funding mechanisms—particularly grants and low-interest loans—are accessible to Black and Brown entrepreneurs who may not have traditional access to generational wealth or coastal banking networks.

Challenges Remaining in the Ecosystem

Despite the optimism, challenges remain. Local founders often cite a “Series B gap”—a difficulty in securing larger amounts of capital (typically $10 million to $30 million) without leaving the state. While early-stage funding (seed and Series A) is healthier than ever, growing companies sometimes face pressure to relocate to New York or California to secure their next major tranche of investment.

“The talent is here, and the early money is here,” explained a local fintech founder. “The challenge is keeping the headquarters here when you need that $50 million check. We need more growth-stage funds to set up shop in Detroit to complete the lifecycle.”

Additionally, keeping the cost of doing business competitive is vital. As real estate values in innovation corridors rise, ensuring that affordable office space remains available for bootstrapped startups is a concern for city planners.

The Role of State and Federal Grants

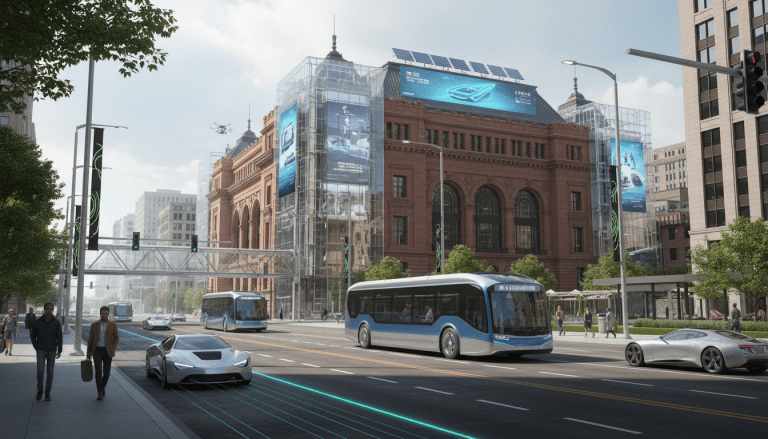

The funding landscape is also being bolstered by federal dollars. Inflation Reduction Act (IRA) grants focused on green energy have found fertile ground in Detroit. Startups focusing on EV charging infrastructure, battery recycling, and energy-efficient building materials are successfully leveraging federal grants to attract matching private investment.

The state of Michigan has also revamped its approach to angel investment tax credits, incentivizing high-net-worth individuals to invest locally rather than looking to out-of-state markets. This policy shift is designed to keep wealth circulating within the local economy.

What Happens Next?

Looking ahead to the remainder of the year, the trajectory for Detroit’s tech sector appears steady. The emphasis is shifting toward sustainable growth rather than the “growth at all costs” mentality that plagued the global tech sector in previous years. Investors are looking for strong unit economics and clear paths to profitability—areas where Detroit startups, known for their grit and practicality, often excel.

With major industry events returning to the city and the continued expansion of the innovation districts, Detroit is positioning itself not just as a place to build cars, but as a place to build the future of business. The capital flowing into the city today is the seed corn for the major employers of the next decade.