The rental landscape in Detroit is undergoing a significant transformation, with Detroit studio apartments becoming a focal point of the city’s evolving housing market. As developers continue to pour resources into the greater downtown area, the availability and pricing of smaller residential units are shifting, creating a complex environment for young professionals, students, and service workers seeking housing in the city center.

Recent data indicates that while inventory is increasing due to new construction in neighborhoods like Midtown, Corktown, and the Central Business District, the median rent for these units is also climbing. This trend mirrors national shifts toward urbanization, yet it presents unique challenges for long-time Detroiters accustomed to a lower cost of living.

For many residents, the studio apartment has historically been an entry point into independent living. However, reported figures from rental platforms such as Zumper and RentCafe suggest that the average price for a studio in the city’s most desirable zip codes has risen steadily over the last 24 months, outpacing wage growth for some sectors of the local economy.

The Shift Toward Luxury Micro-Living

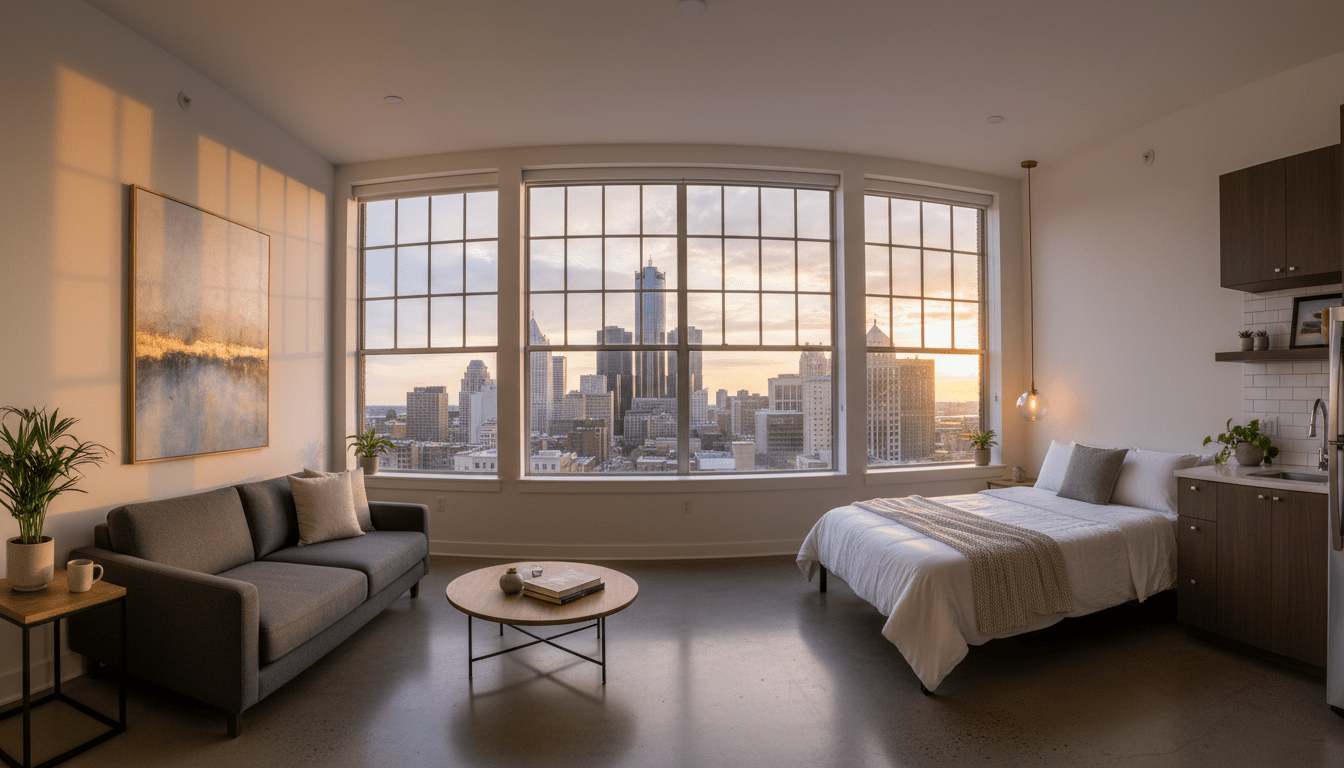

A driving force behind the changes in the market is the influx of luxury developments. Developers are increasingly favoring high-amenity buildings where square footage is traded for communal spaces, rooftop decks, and concierge services. These “micro-units” or efficiency studios are marketed heavily toward a demographic of transient professionals and remote workers moving to the city.

According to planning documents filed with the City of Detroit Housing & Revitalization Department, several ongoing projects have earmarked significant floor plans for studio layouts. The logic is economic: smaller units yield higher rent per square foot. Consequently, the inventory of Detroit studio apartments is technically growing, but the price point is shifting upward.

Real estate analysts note that while this brings density and spending power to downtown corridors, it alters the demographic makeup of the neighborhood. The revitalization of historic buildings—often converted into loft-style studios—adds character but frequently comes with premium price tags that exclude lower-income renters who previously relied on older housing stock.

Impact on Detroit Residents and Workforce

The rising cost of entry for housing in the city center is a critical issue for the local workforce. Service industry workers, artists, and students—groups that traditionally thrive in studio living arrangements—are finding themselves pushed to the periphery of the neighborhoods they help cultivate.

Local housing advocates have expressed concern that the definition of “affordable” in new developments often relies on Area Median Income (AMI) calculations that include wealthy suburbs, skewing the numbers higher than what many actual Detroit residents earn. When a new complex advertises “affordable” units, they are often still out of reach for a resident earning the city’s median individual income.

As covered in previous reports on Detroit neighborhood revitalization, the ripple effect of downtown pricing is being felt in adjacent areas like New Center and Southwest Detroit. As renters are priced out of the downtown core, demand spikes in these neighboring communities, driving up rents for existing residents there as well.

Market Data and Rental Trends

Statistical data paints a clear picture of the current trajectory. Reports from the U.S. Census Bureau and private market analysis firms highlight a disparity between the delivery of high-end units and workforce housing. While the vacancy rate in luxury buildings remains relatively low, indicating strong demand, the vacancy rate for older, Class B and C properties fluctuates.

Market analysts have observed that the average rent for a studio in downtown Detroit can now range significantly higher than the citywide average. In some premier buildings, a 500-square-foot unit can command rents comparable to a three-bedroom home in outlying neighborhoods. This divergence creates a dual market: one for the incoming workforce and one for the existing population.

Furthermore, the competitive nature of the market has changed lease terms. Landlords in high-demand areas are offering fewer concessions than they did two years ago. The “one month free” specials are becoming rarer as occupancy rates for Detroit studio apartments stabilize at higher levels.

Future Outlook for Renters

Looking ahead, the pipeline for residential development in Detroit remains robust. However, the mix of unit types is a subject of ongoing debate at City Council meetings and community planning sessions. There is a growing push to ensure that new developments include deeply affordable units rather than just market-rate studios.

City officials have emphasized their commitment to preventing displacement. Initiatives aimed at preserving existing affordable housing stock are running parallel to new construction incentives. For readers following Detroit development news, the coming year will be a critical test of whether policy can effectively balance the scales between profitable development and housing accessibility.

For now, renters searching for studios in the city must navigate a market that is more expensive and competitive than in previous decades. While the options for modern, amenity-rich living are more plentiful than ever, the search for a budget-friendly unit requires patience and often a willingness to look just outside the immediate downtown loop.