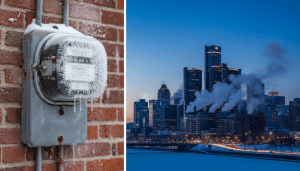

The narrative surrounding Detroit’s real estate market has undergone a significant transformation over the last decade. Once defined by distressed inventory and cash-only transactions, the market is now characterized by rising appraisals, a return to traditional financing, and increased regulatory oversight. For homeowners considering selling a house in Detroit this year, the landscape offers historic equity opportunities balanced against stricter municipal compliance requirements.

Recent data indicates that while the national housing market faces headwinds from fluctuating interest rates, Detroit’s specific market dynamics are creating a unique scenario for sellers. Inventory remains tight in desirable neighborhoods, driving competition, yet the process of closing a deal has become more complex due to enhanced enforcement of city codes.

Rising Valuations and the Appraisal Gap

For years, one of the primary challenges in the city was the “appraisal gap”—where the cost to renovate a home exceeded its market value. However, 2023 and early 2024 have seen a substantial closing of this gap in many neighborhoods.

According to data released by the City of Detroit’s Office of the Assessor earlier this year, residential property values increased by an average of 20% across the city. This marks a continuation of steady growth, bringing many long-term residents into a position of positive equity. For sellers, this means that selling a house in Detroit is no longer just about exiting a property, but potentially capitalizing on significant wealth generation.

“We are seeing appraisals finally catch up to the renovation costs in neighborhoods that were previously stagnant,” reported a spokesperson for a local housing advocacy group. “This allows traditional mortgage lenders to underwrite loans that simply weren’t possible five years ago, expanding the pool of potential buyers beyond just cash investors.”

This shift is critical for the health of the local economy. It suggests that the market is stabilizing and that the reliance on speculative cash buyers is diminishing in favor of owner-occupants who use conventional financing.

The Impact of Regulatory Compliance on Sales

While values are up, the transaction process has become more rigorous. A critical news angle for anyone involved in Detroit property transactions is the city’s crackdown on blight and rental compliance.

The Buildings, Safety Engineering, and Environmental Department (BSEED) has ramped up enforcement regarding Certificates of Compliance. Sellers who have utilized their properties as rentals, or those selling to investors who intend to rent, are finding that transactions can stall without proper inspections. According to the City of Detroit, strict adherence to lead safety and rental codes is a priority to ensure housing stock quality.

For a homeowner selling a house in Detroit, this means that “as-is” sales are facing more scrutiny if the buyer intends to use traditional financing like FHA or VA loans, which have strict safety requirements. The days of handing over a deed with zero inspections are fading in the city’s more stabilized neighborhoods.

Neighborhood-Specific Trends

Real estate activity in Detroit remains hyper-local. While areas like the University District, Palmer Woods, and Corktown continue to command premium prices, middle-market neighborhoods are seeing the most interesting activity. Areas such as Bagley, East English Village, and Rosedale Park are becoming battlegrounds for first-time homebuyers priced out of the suburbs.

Local real estate agents emphasize that the “seller’s market” designation depends entirely on the zip code. “In high-demand zones, we are still seeing multiple offers within the first week if the property is priced correctly,” noted a veteran Detroit broker. “However, overpricing is being punished more severely than it was during the post-pandemic boom. Buyers are price-sensitive due to interest rates.”

The ongoing neighborhood development plans initiated by the city are also influencing buyer psychology. Proximity to new streetscapes and commercial corridors is becoming a major selling point, adding value to homes that might have sat on the market for months in previous years.

Impact on Detroit Residents

The rising market presents a complex reality for native Detroiters. For long-time homeowners, the increase in property value represents a realization of generational wealth. Families who held onto their homes through the bankruptcy era are finally seeing their patience rewarded with tangible equity.

However, this creates a subsequent challenge: where to go next. With interest rates hovering at elevated levels, some residents feel “locked in” to their current homes. Selling a house in Detroit to capture equity often requires buying a new home at a higher interest rate, which can offset the financial gains of the sale. Consequently, inventory remains artificially low because many would-be sellers are choosing to stay put and renovate rather than move.

Future Outlook for 2024

Looking ahead to the remainder of 2024, economic indicators suggest a stabilization of the Detroit market rather than a boom-and-bust cycle. The Detroit Economic Growth Corporation (DEGC) and other stakeholders continue to push for incentives that encourage renovation and occupancy.

For sellers, the window of opportunity is open, but it requires preparation. The market is demanding move-in-ready conditions more than ever before. As detailed by the City of Detroit’s BSEED guidelines, ensuring a property is up to code is the fastest route to a successful closing. The era of the “handyman special” is evolving; while those properties still sell, the premium is firmly on turn-key homes that meet the standards of modern financing.