The debate surrounding the proposed Detroit Land Value Tax is intensifying in Lansing as city officials continue to lobby state lawmakers for approval. The plan, spearheaded by Mayor Mike Duggan, represents a fundamental shift in how property taxes are calculated in the city, with the stated goal of reducing burdens on homeowners while discouraging land speculation.

Under the current system, property taxes are levied equally on the value of the land and the structures built upon it. The new proposal seeks to implement a split-rate tax system. This would significantly lower the tax rate on buildings (homes, businesses) while increasing the tax rate on the land itself. According to city estimates, this shift is designed to reward development and penalize the holding of vacant, unimproved lots that contribute to blight.

Understanding the Mechanics of the Tax Shift

The core mechanism of the Detroit Land Value Tax involves authorization from the Michigan Legislature to allow the city to adjust its millage rates. If passed, the plan would require voter approval via a ballot initiative before taking effect.

“The current tax system punishes people for building and rewards people for doing nothing,” Mayor Duggan stated in a recent press briefing. “We want to flip that equation so that residents who maintain their homes see a tax cut, and speculators sitting on empty land pay their fair share.”

According to an analysis released by the City of Detroit, approximately 97% of homeowners would see a reduction in their annual property tax bills. The average savings are projected to be around 17%, a significant figure for residents in a city that has historically had some of the highest property tax rates in the nation. For more on how local policies affect daily living costs, read our analysis on Detroit’s evolving cost of living trends.

Impact on Blight and Development

Beyond immediate tax relief, the proposal is framed as an anti-blight measure. Detroit has long struggled with speculators purchasing cheap land and leaving it undeveloped, waiting for market values to rise. By tripling the tax rate on land, the cost of holding vacant property would increase significantly, theoretically forcing owners to either develop the land or sell it to someone who will.

Local urban planners suggest this could accelerate development in neighborhoods that have seen slower recovery rates. “It changes the math for developers and neighbors alike,” notes a report from the Citizens Research Council of Michigan, a non-partisan policy research organization. The report indicates that similar split-rate tax systems have been successfully utilized in Pennsylvania to stimulate construction.

Criticism and Legislative Hurdles

Despite the projected benefits, the plan faces hurdles. Some critics and community groups have expressed concern about the complexity of the new assessment model and the potential for unintended consequences on community gardens or side lots owned by residents. However, the city has included specific exemptions in the draft legislation to protect side lots and designated urban farms from the sharpest tax hikes.

Currently, the bills are working their way through the state House, where bipartisan discussions are ongoing. If the legislation clears the House and Senate, the final decision will rest with Detroit voters, potentially appearing on a ballot later this year or in early 2025.

What Happens Next?

As the Michigan Legislature deliberates, Detroit residents are encouraged to review their property assessments to understand how a shift in millage rates might impact them personally. The outcome of this legislation could serve as a bellwether for other Rust Belt cities looking to revitalize their tax bases without displacing long-term residents.

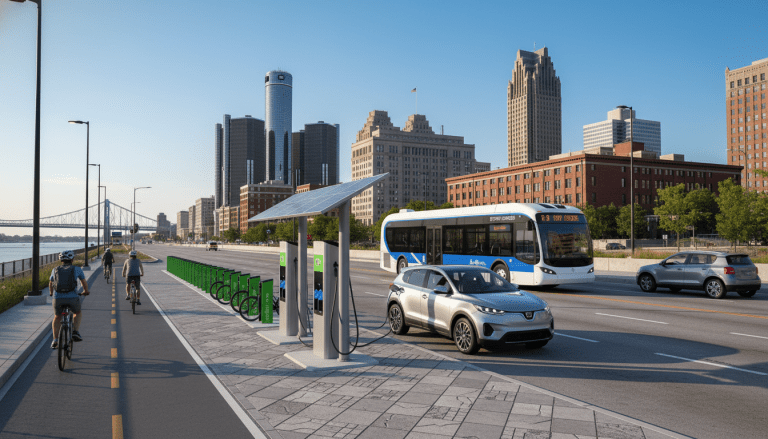

We will continue to track this story as it develops. For updates on other infrastructure projects affecting property values, see our coverage on the Gordie Howe International Bridge progress.