The landscape of Detroit venture capital is undergoing a significant transformation, distinguishing itself from the volatility seen in coastal tech hubs. While national investment trends have fluctuated wildly over the past two years, Detroit’s startup ecosystem has maintained a trajectory of steady, albeit cautious, growth. Driven by a unique blend of automotive heritage and burgeoning software innovation, the city is carving out a niche that prioritizes sustainable scaling over hyper-growth.

Data from the latest reports indicates that while deal counts have normalized following the pandemic boom, the quality of investments in Detroit has matured. Local firms are increasingly doubling down on early-stage companies that bridge the gap between physical manufacturing and digital technology, a sector often referred to as "Industry 4.0." For Detroit, this means the venture capital conversation is no longer just about attracting outside money, but about leveraging local institutional wealth to fuel homegrown innovation.

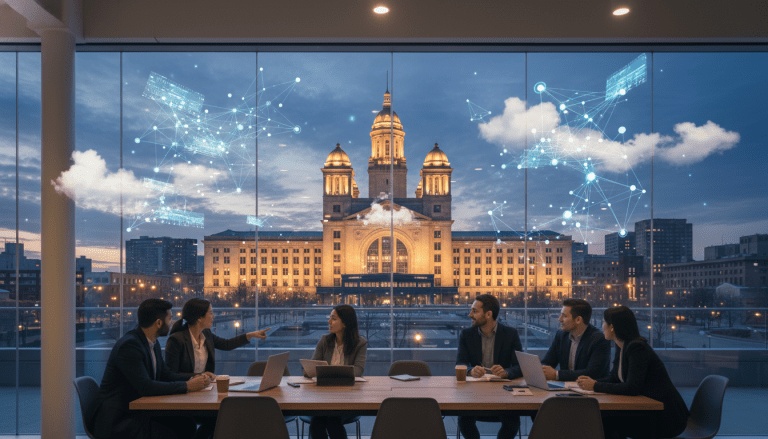

The Evolving Landscape of Detroit Venture Capital

Historically, Detroit’s investment appeal was inextricably linked to the automotive industry. Today, however, the scope has widened. Major players like Detroit Venture Partners (DVP) and Renaissance Venture Capital have been instrumental in diversifying the portfolio of the region. According to recent data from the Michigan Venture Capital Association (MVCA), there has been a notable uptick in funding allocated to fintech, cybersecurity, and mobility startups that operate independently of the traditional OEM supply chain.

This diversification is crucial for the city’s economic stability. Local investors have noted that the ecosystem is shifting from a "flyover" region to a destination for high-value seed and Series A rounds. The presence of startup incubators and accelerators, such as TechTown and Newlab at Michigan Central, has created a pipeline of investable companies that are drawing attention not just from local VCs, but from coastal firms looking for better valuations and disciplined founders.

Analysts suggest that Detroit’s key advantage lies in its cost efficiency. A seed round in Detroit often provides a longer runway than a comparable round in San Francisco or New York, allowing startups to iterate on their products without the immediate pressure of aggressive revenue targets. This environment fosters a specific type of entrepreneur—one focused on unit economics and operational resilience, qualities that are highly attractive to investors in the current economic climate.

Impact on Detroit Residents and Workforce

The influx of Detroit venture capital is not merely a statistic for financial journals; it has tangible implications for the local workforce. As startups secure funding, the immediate effect is job creation in high-skill sectors. However, the ripple effect extends further. The growth of a tech-centric business district, particularly around the Corktown and downtown corridors, supports service industries, construction, and administrative roles.

Furthermore, there is a concerted effort among local VC firms to address equity. Programs designed to support underrepresented founders are gaining traction, aiming to ensure that the wealth generated by the startup boom is not concentrated solely in the hands of established players. Reports indicate that Detroit has one of the higher rates of minority-led startups compared to national averages, though leaders in the space acknowledge there is still significant work to be done to close the funding gap.

For the average resident, the strengthening of the local startup economy offers a buffer against the cyclical nature of the auto industry. As discussed in our coverage of Detroit’s evolving automotive sector, diversifying the job market is essential for long-term municipal health. A robust VC-backed tech sector provides alternative career paths for recent graduates who might otherwise leave the state, helping to reverse the "brain drain" that has plagued Michigan for decades.

Data and Trends: Where the Money Flows

Analyzing recent investment rounds reveals clear patterns in where capital is being deployed. Mobility remains the crown jewel, accounting for a significant plurality of venture dollars. However, enterprise software (B2B SaaS) has emerged as a strong runner-up. Investors are favoring companies that solve unglamorous, high-friction problems in logistics, healthcare, and manufacturing supply chains.

Statistics from regional economic development organizations show that the total capital under management by Detroit-based firms has increased steadily over the last five years. While mega-rounds (deals exceeding $100 million) remain rare compared to Silicon Valley, the volume of deals in the $1 million to $5 million range is healthy. This "middle market" of venture capital is critical for sustaining a vibrant ecosystem, as it supports companies moving from the proof-of-concept phase to market expansion.

Additionally, corporate venture capital (CVC) plays a larger role in Detroit than in many other cities. Arms of major corporations, including the Big Three automakers and large healthcare providers, are active participants in funding rounds. This provides startups not just with capital, but with immediate access to potential customers and pilot programs, a strategic advantage that pure financial investors cannot always offer.

Challenges in the Funding Pipeline

Despite the optimism, the Detroit venture capital scene faces distinct hurdles. The most cited challenge is the "Series B gap." While seed and Series A funding have become more accessible, local companies often struggle to raise larger growth-stage rounds within the state. This forces successful startups to look to coastal investors for capital injections of $20 million or more, which sometimes leads to headquarters relocating or executive teams shifting focus away from Detroit.

Local founders also cite a need for more specialized talent. While engineering talent is abundant, finding experienced executives who have successfully scaled a startup from 50 to 500 employees remains difficult locally. Recruiting this talent often requires competitive compensation packages that test the limits of local funding rounds.

Furthermore, macroeconomic factors such as interest rate hikes have made capital more expensive globally. While Detroit’s ecosystem is somewhat insulated due to its lower reliance on speculative valuations, local firms are becoming more rigorous in their due diligence. The "growth at all costs" mentality has been replaced by a demand for clear paths to profitability, changing how founders pitch their businesses.

What Happens Next

Looking ahead to 2025 and beyond, the trajectory for Detroit’s investment community appears stable. The maturation of the Michigan Central innovation district is expected to act as a gravity well for mobility startups and the investors who fund them. This physical centralization of innovation helps facilitate the "accidental collisions" and networking that drive deal flow in denser cities.

Experts anticipate a rise in collaborative funds, where multiple regional firms pool resources to lead larger rounds, potentially addressing the Series B gap. Additionally, as reported in our analysis of Detroit’s tech infrastructure, state-level initiatives to provide matching funds or investment guarantees may further de-risk early-stage investments.

For Detroit, the goal is not to become the next Silicon Valley, but to become the premier hub for tangible, industrial innovation. By focusing on sectors where the city holds a competitive advantage and fostering an inclusive investment culture, Detroit is building a venture capital ecosystem that is as resilient as the city itself.