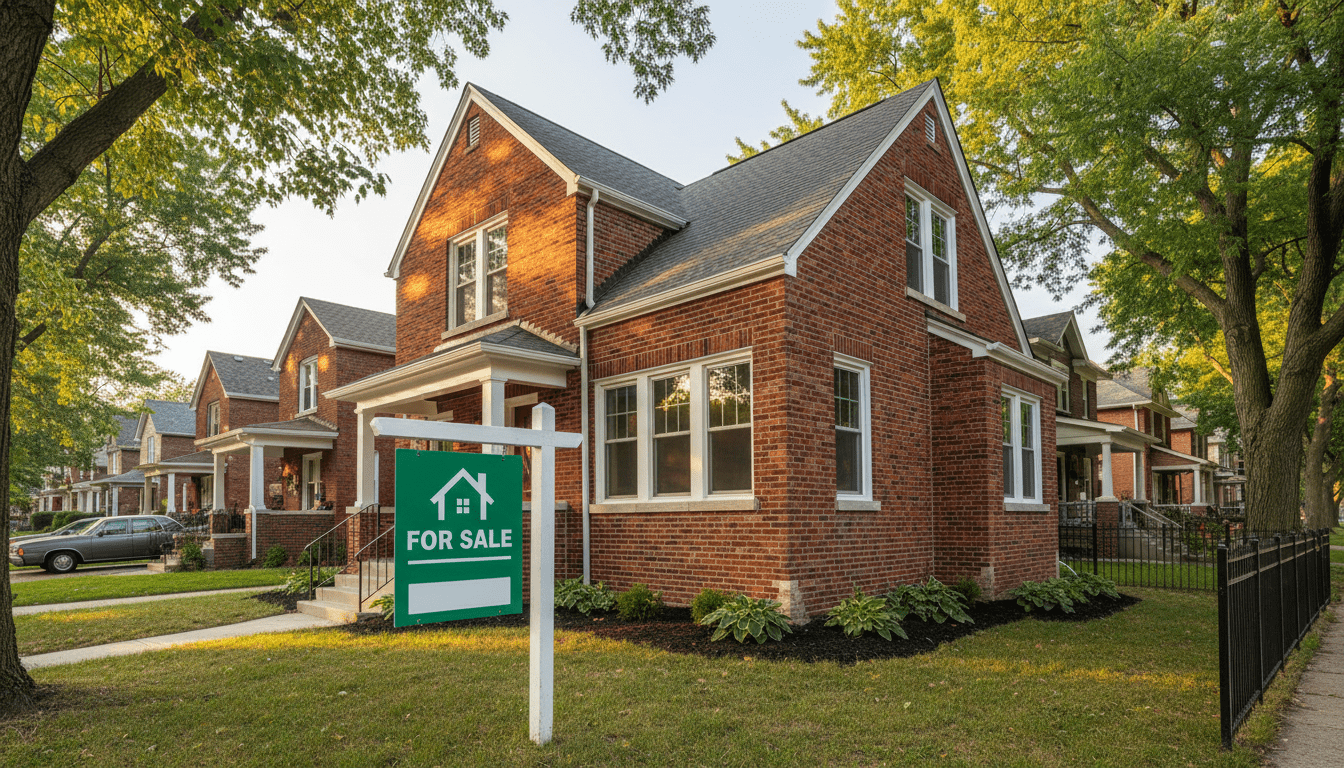

The real estate landscape in Detroit is currently defined by a persistent imbalance: Detroit housing demand is steadily outpacing the available supply of move-in ready homes. While national trends have shown fluctuations due to interest rate volatility, Detroit’s market has remained surprisingly resilient, driven by affordability relative to other major metros and continued investment in neighborhood revitalization.

According to recent data from the Detroit Association of Realtors and broader market analyses, the inventory of homes for sale remains near historic lows. This scarcity is creating a competitive environment for buyers, particularly in stabilized neighborhoods where renovation efforts have taken root. For prospective homeowners, the narrative of the current market is one of limited options and rising competition.

Rising Detroit Housing Demand Meets Low Inventory

The primary driver of the current market dynamic is a shortage of quality inventory. Many existing homeowners are “locked in” to low mortgage rates secured during the pandemic era, making them reluctant to sell. Consequently, the flow of existing homes entering the market has slowed significantly.

Data indicates that while listing prices have stabilized in some areas, the sale-to-list price ratio remains healthy, suggesting that well-priced homes are still attracting immediate attention. This is particularly true for turnkey properties. Buyers are increasingly wary of fixer-uppers due to high material and labor costs, concentrating the Detroit housing demand specifically on renovated properties.

“The challenge isn’t a lack of interest in Detroit; it is a lack of product that meets the financing requirements for traditional mortgages,” reported local real estate analysts. This bottleneck means that while people want to buy in the city, the housing stock often requires cash offers or specialized renovation loans, which limits the pool of eligible buyers.

For more on the city’s economic backdrop driving this interest, read about the current Detroit economic outlook and how business development is fueling local jobs.

Impact on Detroit Residents and Affordability

The surge in demand has a dual effect on Detroit residents. For long-time homeowners, rising property values represent a significant increase in generational wealth. Neighborhoods that saw stagnant values for decades are now seeing appreciation that allows residents to access home equity.

However, for renters and first-time homebuyers, the equation is more difficult. As prices rise, the barrier to entry becomes steeper. Housing advocates have raised concerns that if supply does not increase to meet the Detroit housing demand, the city could face an affordability crisis similar to other recovering cities.

The City of Detroit Housing and Revitalization Department has acknowledged these pressures. Officials have stated that increasing the density of affordable housing and streamlining the process for land bank property rehabilitation are top priorities. By converting vacant land bank properties into occupied homes, the city aims to alleviate the supply crunch without displacing current residents.

To understand how infrastructure changes are supporting these neighborhoods, check our coverage on major Detroit infrastructure projects currently underway.

Market Data and Regional Trends

The U.S. Census Bureau notes that while Detroit’s population decline has leveled off, the household composition is changing. There is a growing demographic of younger professionals and smaller households seeking residence in the city, further altering the types of housing needed.

Real estate platforms like Zillow and Rocket Homes have reported that homes in neighborhoods such as Bagley, University District, and Corktown are seeing shorter days-on-market averages compared to the regional average. This suggests that demand is not uniform; it is hyper-localized to areas with strong community associations and amenities.

The Role of Interest Rates

While Detroit remains one of the most affordable major cities in the United States, interest rates have dampened purchasing power. A household that could afford a $150,000 home two years ago now faces significantly higher monthly payments. Despite this, the relative affordability of Detroit compared to suburbs like Royal Oak or Ferndale keeps the city attractive to budget-conscious buyers.

What Happens Next?

Looking ahead, experts suggest that the tension between high Detroit housing demand and low supply will likely continue through the remainder of the year. The key variable will be new construction and the pace of rehabilitation projects.

Local developers are increasingly focusing on “middle housing”—duplexes and townhomes—that can provide density at a lower price point. Furthermore, the proposed Land Value Tax, which is currently under discussion, could radically shift the market by discouraging land speculation and encouraging development on vacant lots. If implemented, this could unlock a wave of new inventory that might finally balance the market.

For now, buyers in Detroit must be prepared to move quickly and navigate a market where quality homes are a scarce commodity.